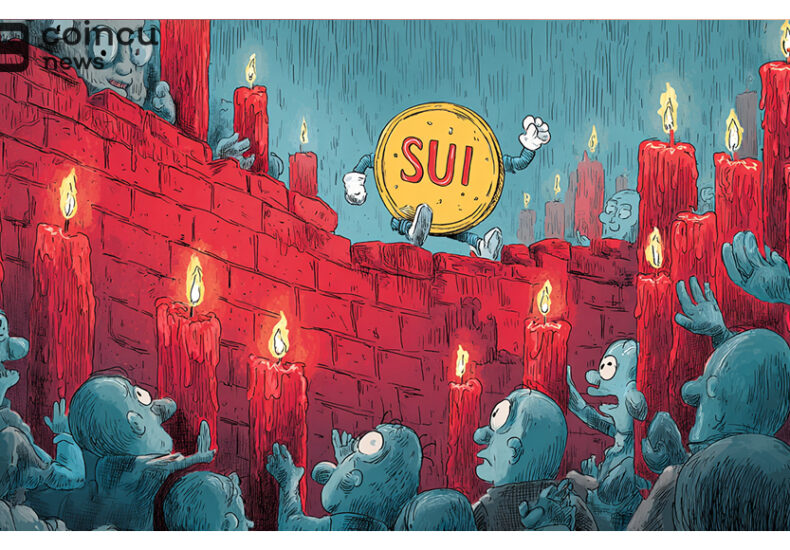

SUI Bounces at $2.55, But Heavy Sell Wall Looms

**SUI Price Analysis: Support Holds Near $2.55 Amid Low Buying Volume**

Sui (SUI) has been holding support around the $2.55 mark but continues to struggle to break through key resistance levels due to low buying volume. After a weekly decline of over 20%, SUI was trading near $2.68, maintaining price levels above vital support but showing weak momentum and facing strong overhead resistance. Traders are closely watching to see if the current price range will hold or break in the coming sessions.

**Short-Term Support Holds Near $2.55**

On the 4-hour chart, SUI has been consistently reacting around the $2.55 to $2.58 range, which acted as a strong support level earlier in October. Each bounce from this zone, however, has struggled to gain traction for further gains. Price has failed to test nearby resistance zones spanning from $2.90 to $3.40.

Volume remains low, indicating limited buyer interest, and the Relative Strength Index (RSI) is hovering near 40. This RSI level points to a weak recovery following a dip into oversold territory, resulting in a tight trading range due to lackluster momentum.

**Weekly Chart Shows Structure Holding**

Looking at the weekly chart, SUI continues to form higher lows, signaling that the overall structure of the trend remains intact. The token remains above the support zone near $2.63—the base of the previous breakout from late 2024—which has successfully held through multiple pullbacks.

Market analyst Michaël van de Poppe notes, “The structure hasn’t changed on SUI,” referring to the ongoing pattern of higher lows as evidence that the bullish trend is still valid. Resistance around $4.20 has been tested multiple times, and these repeated attempts suggest that sellers may be weakening.

**Volume Still Lacking for Breakout**

According to Umair Crypto, SUI’s price action is facing rejection before it can fully test major resistance levels. He emphasizes, “What’s needed now is strong volume.” Without sufficient volume, the token lacks the momentum needed to push higher.

As it stands, SUI remains stuck between the $2.55 support and the overhead resistance levels. Unless buying volume picks up, the sideways movement is likely to continue, favoring sellers. A decline below $2.58 could shift focus toward lower price targets.

**Network Developments Continue Amid Price Stagnation**

Outside of price action, the Sui network is showing positive signs of growth and development. Notably:

– Grayscale has established trusts linked to Sui-based projects.

– Stablecoin and Bitcoin value locked on the Sui network have increased over recent months.

– Bluefin DEX, operating on Sui, reached record trading volumes in October.

– A new partnership with Figure Technology is bringing the YLDS token to Sui. This token is backed by short-term Treasurys and repo agreements.

These developments suggest that while price movement remains limited, underlying network activity and adoption are expanding, signaling potential for future growth.

—

*Stay tuned for further updates as SUI navigates critical support and resistance levels amid ongoing network progress.*

https://bitcoinethereumnews.com/tech/sui-bounces-at-2-55-but-heavy-sell-wall-looms/?utm_source=rss&utm_medium=rss&utm_campaign=sui-bounces-at-2-55-but-heavy-sell-wall-looms

You may also like

延伸阅读

You may be interested

GST 2.0: Maruti cars become cheaper by up to ₹1.3L

**GST 2.0: Maruti Cars Become Cheaper by Up to ₹1.3...

Most Popular Crypto Picks for 2025: BlockDAG, SOL, HBAR & PEPE Lead the Charge

Discover Why BlockDAG at $0.0013 Is a Presale Gem, Alongside...

Valour’s Bitcoin Staking ETP on LSE May Offer New Yield Options for Institutional Bitcoin Holders

**Bitcoin Staking ETP: Valour Launches 1.4% Yield Product on London...

The New York Times

The New York Times

- Trump’s Rift With Europe Is Clear. Europe Must Decide What to Do About It. 2026 年 1 月 22 日 Steven Erlanger and Jeanna Smialek

- Former Uvalde Officer Adrian Gonzales Found Not Guilty of Endangering Children in Mass Shooting 2026 年 1 月 22 日 Edgar Sandoval

- My Rohingya People Are Running Out of Time 2026 年 1 月 22 日 Lucky Karim

- China Wins as Trump Cedes Leadership of the Global Economy 2026 年 1 月 22 日 Peter S. Goodman

- Court Removes Restrictions on ICE’s Use of Pepper Spray, for Now 2026 年 1 月 22 日 Mitch Smith

- Snow Maps and More: Everything You Could Want to Know About This Winter Storm 2026 年 1 月 22 日 Nazaneen Ghaffar and Erin McCann

- Cuban Detainee in El Paso ICE Facility Died by Homicide, Autopsy Shows 2026 年 1 月 22 日 Pooja Salhotra

- Trump Drops Tariff Threats Over Greenland After Meeting With NATO Chief 2026 年 1 月 22 日 Lara Jakes, Jim Tankersley and Zolan Kanno-Youngs

- Heart Disease and Stroke Still Leading Causes of Death in U.S. 2026 年 1 月 22 日 Nina Agrawal

- An Unhinged President on the Magic Mountain 2026 年 1 月 22 日 Bret Stephens

Leave a Reply