epstein_scandal . journalism_investigation

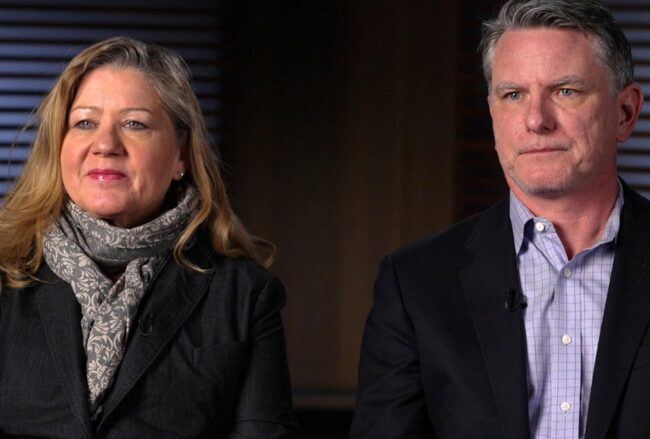

Finding the voices to shed light on how Epstein used visits to Interlochen to target girls

Audio will be available later today. In an in-depth investigation, an NPR reporting team thoroughly examined the Epstein documents related to the Interlochen Center for the Arts. Their work has shed new light on how Jeffrey Epstein and Ghislaine Maxwell exploited their access to this highly respected institution to target young girls. Stay tuned for […]