MicroStrategy Unlikely to Liquidate Bitcoin in Next Bear Market, Analyst Says

MicroStrategy’s Debt Repayment Strategy Minimizes Bitcoin Liquidation Risk

MicroStrategy’s approach to managing its debt offers significant flexibility, allowing repayment through cash or stock issuance. This strategy helps the company avoid selling its substantial Bitcoin holdings, provided its shares stay above a critical threshold of $183.19. At the current Bitcoin price of $101,377, MicroStrategy maintains a comfortable buffer against liquidation even during moderate market downturns.

### Strong Bitcoin Holdings Backing MicroStrategy’s Position

The company holds approximately 641,205 BTC, valued around $64 billion as of now. Analysts forecast that these robust holdings will remain intact unless the market experiences a severe and sustained bear run. Bitcoin analyst Willy Woo has expressed confidence that MicroStrategy is unlikely to be forced into selling Bitcoin in the next downturn, thanks to its convertible debt structure and the current valuations.

—

### Why Is MicroStrategy’s Bitcoin Liquidation Risk Low?

MicroStrategy’s convertible senior notes are structured to be repaid via cash, common stock, or a combination of both. This flexibility means the firm can choose not to liquidate Bitcoin assets unless market conditions become extreme. The debt terms create a safeguard, allowing the company to sustain its Bitcoin reserves even through typical market volatility.

—

### How Does the Debt Structure Protect Bitcoin Holdings?

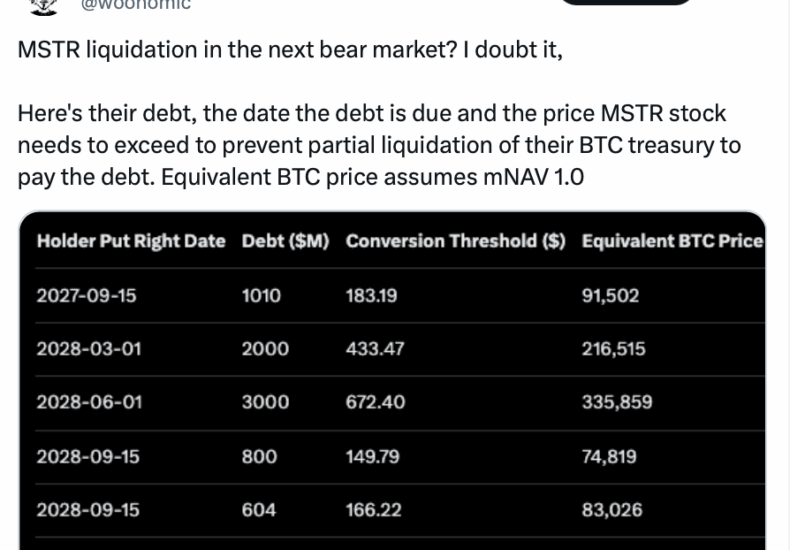

The company’s convertible senior notes mature in phases, with a notable $1.01 billion maturity due on September 15, 2027. To meet this obligation without selling Bitcoin, MicroStrategy’s stock price must stay above $183.19. Willy Woo has analyzed this threshold, noting it corresponds roughly to a Bitcoin price of $91,502, assuming a net asset value multiple of 1.

This arrangement reveals the company’s built-in resilience. Should the stock maintain this price level, MicroStrategy can repay debt through equity issuance rather than asset liquidation. Market data supports this view with the company’s Bitcoin holdings providing a strong equity base.

—

### Expert Insights on Market Resilience

Analysts such as The Bitcoin Therapist emphasize that only an exceptionally prolonged and deep bear market would compel MicroStrategy to sell its Bitcoin holdings. This underscores the strategic advantages of the company’s approach, particularly in volatile markets.

Under CEO Michael Saylor’s leadership, MicroStrategy has positioned itself as one of the largest corporate Bitcoin holders by leveraging debt and equity to fund acquisitions. This strategy not only diversifies repayment options but also capitalizes on Bitcoin’s potential appreciation.

—

### Current Market Snapshot

– **Bitcoin Price:** $101,377 (down 9.92% over the past week per CoinMarketCap)

– **MicroStrategy Stock Price:** $246.99 (down 6.7% but above critical threshold)

Willy Woo’s commentary highlights that with such buffers in place, immediate Bitcoin liquidation is improbable. This fosters investor confidence in MicroStrategy’s long-term commitment to its Bitcoin treasury strategy.

Further supporting this, The Bitcoin Therapist notes that for any sales to occur, Bitcoin’s performance would need to be extraordinarily poor over an extended period—far beyond typical market cycles.

—

### Debt Management and Financial Engineering

MicroStrategy’s financial strategy is characterized by prudent debt management, with conversion rights favoring equity dilution over selling Bitcoin. There is currently no immediate pressure on the company’s balance sheet that would force liquidation.

Historically, MicroStrategy has continued adding to its Bitcoin inventory during market dips, signaling steadfast support for its treasury management approach.

—

### Frequently Asked Questions

**Will MicroStrategy Face Bitcoin Liquidation Risks in 2027?**

MicroStrategy’s $1.01 billion debt due in 2027 can be settled without liquidating Bitcoin as long as the stock price remains above $183.19, which correlates to a Bitcoin price near $91,502. Analysts consider this a high and protective threshold, making liquidation unlikely except during an unprecedented bear market.

**How Has MicroStrategy’s Stock Performance Affected Its Bitcoin Strategy?**

Despite recent declines, MicroStrategy’s stock price remains well above key debt conversion levels. This resilience supports flexible debt repayment options without the need to sell Bitcoin, allowing the company to continue purchasing and holding a massive Bitcoin portfolio valued at $64 billion.

—

### Key Takeaways

– **Debt Flexibility Shields Bitcoin Assets:** Convertible notes permit repayment in stock or cash, significantly reducing liquidation risk unless market prices fall dramatically below $91,500.

– **Analyst Consensus on Resilience:** Experts like Willy Woo and The Bitcoin Therapist predict that only an extreme bear market could force MicroStrategy to sell Bitcoin.

– **Strong Holdings and Strategic Position:** With over 641,000 BTC worth $64 billion, monitoring stock price thresholds and Bitcoin trends is vital for assessing MicroStrategy’s long-term stability.

—

### Conclusion

MicroStrategy’s risk of liquidating Bitcoin holdings in the near term remains low, supported by innovative debt structures and substantial asset backings. As Willy Woo points out, only a catastrophic bear market would challenge this position.

Moreover, notable investors such as Cathie Wood and Brian Armstrong forecast Bitcoin’s potential surge to $1 million by 2030, further validating MicroStrategy’s long-term strategy. Investors should stay alert to market cycles but can look to MicroStrategy’s model as an example of corporate confidence in cryptocurrency’s enduring value.

As crypto markets evolve, MicroStrategy’s steadfast commitment to Bitcoin sets a benchmark for institutional adoption. The company’s resilience highlights the importance of understanding corporate balance sheets and strategic treasury management in crypto investing.

Even as Bitcoin experiences temporary dips, currently priced at $101,377, MicroStrategy’s position remains robust, offering valuable lessons on leveraging market volatility to reinforce strategic advantages.

—

Stay informed on MicroStrategy’s evolving crypto strategy and explore similar treasury approaches to strengthen your own financial planning in the dynamic world of digital assets.

https://bitcoinethereumnews.com/bitcoin/microstrategy-unlikely-to-liquidate-bitcoin-in-next-bear-market-analyst-says/

You may also like

相关资源

You may be interested

Globe bets on prepaid fiber, sets expansion

No content was provided to convert. Please provide the text...

Bragging rights up as Samal makes 5150 debut

A stellar Open division field will be shooting for the...

DigiPlus launches P1-M surety bond program

MANILA, Philippines — DigiPlus Interactive Corp. has partnered with Philippine...

The New York Times

The New York Times

- Air Canada Cancels Flights to Cuba as Cuba Runs Out of Jet Fuel 2026 年 2 月 10 日 Frances Robles

- The Epstein Files Are Coming for Keir Starmer 2026 年 2 月 10 日 Moya Lothian-McLean

- Bangladesh Exposed the Deeper Problem Facing Democracy 2026 年 2 月 10 日 Zahid Hussain and Tom Felix Joehnk

- Nicaragua Blocks a Route from Cuba to the U.S. 2026 年 2 月 10 日 James Wagner

- How Italy’s Police and Army Compete to Enlist Italian Olympians 2026 年 2 月 10 日 Jason Horowitz

- New Email Shows Bard President Leon Botstein Thanked Epstein for Caribbean Trip 2026 年 2 月 10 日 Vimal Patel

- Appeals Court Lets Trump Revoke Deportation Protections for 60,000 More Migrants 2026 年 2 月 10 日 Chris Cameron

- Judge Strikes Down California’s Ban on Masks for Federal Agents 2026 年 2 月 10 日 Laurel Rosenhall

- A Campaign to Revoke the Endangerment Finding Appears Near ‘Total Victory’ 2026 年 2 月 10 日 Lisa Friedman and Maxine Joselow

- Trump Threatens to Block Opening of Gordie Howe International Bridge to Canada 2026 年 2 月 10 日 Chris Cameron and Vjosa Isai

Leave a Reply