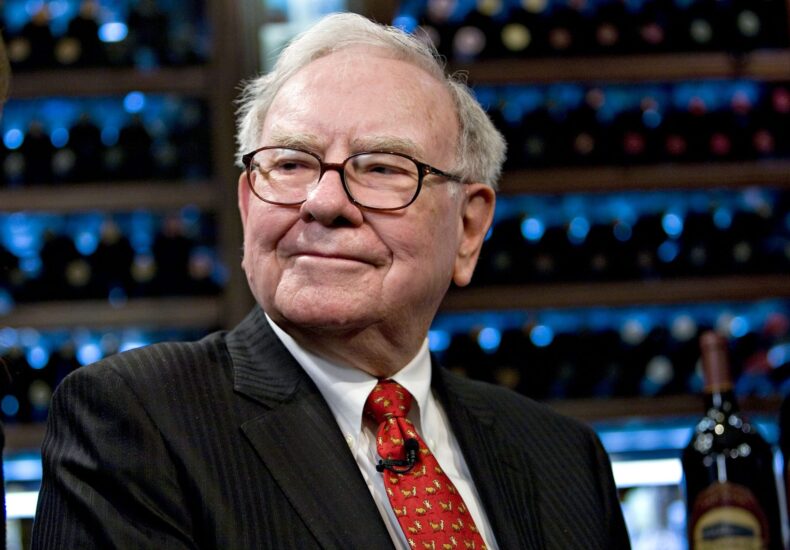

Warren Buffett plowed more than $1 billion into three stocks, and it says a lot about where he sees consumers’ priorities right now: Houses, beer, and gas

Throughout 2025, Berkshire Hathaway’s investments have focused on brands heavily exposed to the health and prospects of consumers. American shoppers have held up well since the end of the pandemic—much to the surprise of some economists.

Brian Moynihan, the CEO of Buffett’s long-held asset Bank of America, said earlier this year that while consumers were beginning to worry about their cash reserves, they were continuing to spend nonetheless.

Meanwhile, Wall Street and Silicon Valley have been piling into AI stocks despite warnings of a bubble. In contrast, Warren Buffett and his successor, Greg Abel, have been looking further afield for investment inspiration. Some of Berkshire’s largest investments this year have been in brands that likely qualify as essential for U.S. shoppers—or reflect their long-term goals.

For example, Berkshire’s most recent filings reveal it now holds some 7 million shares in the Lennar Corporation, a 265% increase on its previous stake. Lennar, one of the nation’s largest home builders, has seen its share price drop 28% in the past year but now makes up a little over 3% of Berkshire’s portfolio. The company’s class A and B stock holdings total more than $886 million.

Action from the White House this year has also focused on getting America’s real estate market moving again. In his continued lobbying for a lower base interest rate, President Trump claimed Fed Chairman Jerome Powell was “hurting the housing industry very badly.” Trump added: “People can’t get a mortgage because of him.”

While Chair Powell refrained from lowering the rate in the early days of Trump’s administration, the Federal Open Market Committee has since begun lowering interest rates and signaled an openness to further reductions in the future. Although the federal funds rate doesn’t directly set mortgage rates lenders offer, lower borrowing costs generally lead to more affordable mortgage options for consumers.

This monetary trajectory sits on top of a basic supply and demand issue: housing is in short supply. According to a 2025 study from the U.S. Chamber of Commerce, America faces a “severe” shortage of more than 4.7 million homes.

The report also notes that policies like tariffs aren’t helping the crisis: “Rising costs and limited supply are slowing new home construction despite high demand—underscoring the need for robust and lasting solutions to strengthen supply chain resilience and incentivize building to support the housing sector’s growth and stability.”

### Consumables Focus

Also among Berkshire’s recent purchases was an increased stake in Chevron. According to Stockcircle, the company added 3.45 million shares in the second quarter of this year.

The oil and gas industry has suffered a bumpy few years following Russia’s invasion of Ukraine and the ensuing supply issues. However, in U.S. markets specifically, the price of gasoline and fuel oil have been the only two energy commodities to post negative inflation data over the past 12 months.

With prices at more stable levels for consumers, Bank of America noted that gas drove spending growth last month. In a note seen by Fortune, BofA wrote that gasoline accounted for around a third of growth across all consumer buying last month—after spending had contracted in the first three months of this year.

https://fortune.com/2025/10/17/warren-buffett-billion-investment-chevron-constellation-home-builder-consumer-priorities/

You may also like

更多推荐

You may be interested

Globe bets on prepaid fiber, sets expansion

No content was provided to convert. Please provide the text...

Bragging rights up as Samal makes 5150 debut

A stellar Open division field will be shooting for the...

DigiPlus launches P1-M surety bond program

MANILA, Philippines — DigiPlus Interactive Corp. has partnered with Philippine...

The New York Times

The New York Times

- Late Night Doesn’t Understand Why America Is Attacking Iran 2026 年 3 月 5 日 Trish Bendix

- In a Riskier Era, China Bets on Technology to Resist U.S. Pressure 2026 年 3 月 5 日 Chris Buckley and Lily Kuo

- Senate Thwarts Bid to Curb Trump’s War Powers on Iran 2026 年 3 月 5 日 Robert Jimison

- China Sets Economy’s Growth Target Below 5% for First Time in Decades 2026 年 3 月 5 日 Aaron Krolik

- Australia’s Sydney Jewish Museum to Memorialize Bondi Beach Massacre 2026 年 3 月 5 日 Laura Chung and Matthew Abbott

- James Talarico Says ‘New Politics Is Being Born’ After Texas Primary Win 2026 年 3 月 5 日 Ramón Ramirez

- Contract for El Paso ICE Center Is Under Review, Homeland Security Says 2026 年 3 月 5 日 Pooja Salhotra and Madeleine Ngo

- Several of Labor Secretary Lori Chavez-DeRemer’s employees are under investigation for official misconduct under her leadership. 2026 年 3 月 5 日 Rebecca Davis O’Brien

- Daines Drops Re-election Bid in Montana, Upending a Senate Race 2026 年 3 月 5 日 Kellen Browning

- Trump Follows His Gut. His National Security Advisers Try to Keep Up. 2026 年 3 月 5 日 David E. Sanger

Leave a Reply