Understanding QQQ Stock: Insights and Investment Strategies

Understanding QQQ Stock

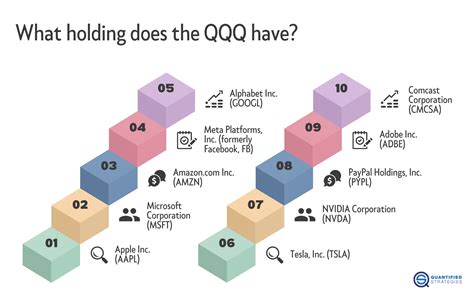

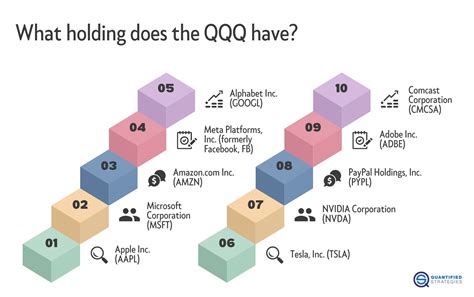

QQQ stock represents the Invesco QQQ Trust, which primarily consists of the largest non-financial companies listed on the Nasdaq. Investors are drawn to QQQ due to its heavy emphasis on technology, featuring well-known giants such as Apple, Microsoft, and Amazon. This tech-centric focus has driven notable growth in recent years, leading many to consider QQQ a benchmark for tech performance.

One compelling reason behind its popularity is its performance compared to the S&P 500. Historically, QQQ has consistently outperformed this broader index, reflecting investor confidence in the technology sector’s potential for growth. Notably, the fund uses a modified capitalization-weighted methodology to select stocks, which places more emphasis on larger companies and may contribute to its above-average returns.

"Investors should always consider their risk tolerance and market conditions when exploring investment options."

The following table summarizes some key attributes of QQQ stock compared to S&P 500:

| Attribute | QQQ | S&P 500 |

|---|---|---|

| Focus | Technology-heavy | Diverse sectors |

| Historical Growth | Higher than average | Moderate stability |

| Volatility | Higher | Lower |

For further insights into navigating investments and maximizing returns while considering volatility, you can refer to sources such as MarketWatchor Invesco QQQ. Exploring investment strategies tailored to your needs can help in effectively harnessing the potential of QQQ stock while mitigating risks associated with market fluctuations.

The Tech Focus of QQQ

The Invesco QQQ Trust, commonly known as QQQ, is heavily focused on the technology sector. This ETF primarily tracks the Nasdaq-100 Index, which is comprised of the 100 largest non-financial companies listed on the Nasdaq Stock Market. A significant portion of QQQ’s holdings includes industry giants such as Apple, Microsoft, and Amazon, reflecting the increasing prominence of technology in today’s economy. Investors are drawn to QQQ because technology stocks have historically shown strong growth potential. Moreover, as these companies continue to innovate and expand their market reach, they can drive substantial returns for investors. Understanding this tech focus allows investors to appreciate how developments in the tech landscape can influence QQQ’s performance over time. For a deeper look into how these movements impact stock prices, click here. Additionally, resources like Robinhoodprovide real-time data on QQQ that can be beneficial for those looking to invest strategically in this dynamic sector.

Selection Criteria Explained

When considering an investment in QQQ stock, understanding the criteria for its selection is crucial. The index tracks the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Market, with a strong emphasis on technology. The selection criteria for QQQ include market capitalization, where only well-established firms with a significant market cap qualify, ensuring stability and growth potential. Additionally, companies must demonstrate a strong financial performance, including consistent revenue growth and profitability. This focus results in exposure to cutting-edge sectors such as software, biotechnology, and consumer electronics. As investors navigate their options, recognizing these factors may offer insights into how QQQ maintains its competitive edge over traditional indices like the S&P 500. Understanding these criteria can be enhanced by exploring resources like this Reddit discussionand insights from Bradford Tax Institute.

QQQ vs. S&P 500 Performance

The QQQ, which tracks the Nasdaq-100 Index, has consistently shown strength compared to the S&P 500. One reason is its concentrated exposure to the technology sector, which has been a significant driver of growth in recent years. Companies like Apple, Microsoft, and Amazon make up substantial portions of the QQQ, leveraging innovations that have led to increased productivity and market demand. The S&P 500, while inclusive of various sectors, faces slower growth in industries like energy and consumer staples.

Additionally, performance metrics such as total return and market volatility reveal that the QQQ often outpaces its broader counterpart. This divergence is reflected in various investment strategies that have attracted traders looking for higher returns from tech-centric stocks. For a detailed performance analysis of QQQ stock over different time periods, interested individuals can visit Yahoo Financeor explore Invesco’s insightson its growth trends and underlying strategies. Understanding these dynamics offers a clearer perspective on the potential benefits of investing in QQQ compared to traditional equity benchmarks like the S&P 500.

Investment Strategies for QQQ

Investing in QQQ requires a clear understanding of both market trends and individual strategies that align with its unique characteristics. A popular approach is dollar-cost averaging, where investors consistently buy shares over time, thereby mitigating the impact of market volatility. This strategy is particularly useful for QQQ, as technology stocks can experience sharp price fluctuations. Moreover, examining technical indicators such as moving averages can provide insights into potential entry and exit points.

Investors may also consider utilizing options strategies to enhance returns or hedge against downside risks. For instance, covered calls can generate income by allowing investors to sell call options against their existing shares. Additionally, maintaining a balanced portfolio by diversifying with other asset classes reinforces risk management, especially in light of QQQ’s tendency to change with technological advancements.

For more insights on related investment strategies in this realm, visit What insider trading reveals about ProShares Trust ProShares UltraPro Short QQQ stockand Will ProShares Trust ProShares UltraShort QQQ stock hit new highs in YEAR. This approach assists investors in navigating the complexities of the tech-focused landscape that QQQ embodies.

Navigating QQQ’s Volatility

Investing in QQQ stock presents unique challenges, primarily due to the inherent volatility of the technology sector. Investors should be prepared for price fluctuations that can occur rapidly in response to market news, earnings reports, or changes in economic conditions. To navigate this volatility effectively, it is essential to adopt a strategy that includes diversification and risk management. For instance, implementing stop-loss orders can help mitigate potential losses during downturns. Additionally, staying informed about macroeconomic trends and specific developments affecting tech companies within the QQQ can provide critical context for making investment decisions. Understanding historical performance patterns and recognizing times of increased uncertainty can also guide investors in timing their entries and exits more effectively. By cultivating a disciplined approach, investors can better manage the risks associated with QQQ’s price movements while capitalizing on its growth potential.

Benefits of Investing in QQQ

Investing in QQQ offers several distinct advantages that can appeal to different types of investors. Primarily, QQQ provides exposure to a diverse range of technology-focused companies, which have shown robust growth potential. This sector’s ongoing innovation often leads to higher returns compared to traditional industries. Moreover, QQQ typically boasts lower expense ratios than actively managed funds, making it a cost-effective option for investors seeking long-term growth without incurring significant fees. Additionally, the liquidity of QQQ allows for easier trading, enabling investors to react swiftly to market changes. The fund’s historical performance often outpaces that of the S&P 500, making it an attractive choice for those looking to capitalize on tech sector trends while maintaining a diversified portfolio.

You may also like

「CISプラス」創設で合意 プーチン氏ら、旧ソ連の首脳会議

Impact of the De Minimis Exemption on U.S. Imports Explained

推荐阅读

You may be interested

Transformative Leadership Practices of the Target CEO

Transformative Leadership Skills Transformative leadership skills are essential in today's...

Experience the Unique Charm and Thrills of Jackson Hole

The Enchantment of Jackson Hole Nestled amidst the breathtaking Teton...

Walmart Stock Performance Insights and Future Outlook

Walmart Stock Historical Trends Walmart's stock performance has displayed a...

The New York Times

The New York Times

- Department of Homeland Security Shuts Down, Though Essential Work Continues 2026 年 2 月 14 日 Madeleine Ngo

- Casey Wasserman Will Sell Entertainment Agency Amid Epstein Files Fallout 2026 年 2 月 14 日 Shawn Hubler, Ben Sisario and Emmanuel Morgan

- New Research Absolves the Woman Blamed for a Dynasty’s Ruin 2026 年 2 月 14 日 Andrew Higgins

- How China Built a Chip Industry, and Why It’s Still Not Enough 2026 年 2 月 14 日 Meaghan Tobin

- ’The Interview’: Gisèle Pelicot Shares Her Story 2026 年 2 月 14 日 Lulu Garcia-Navarro

- Ramping Up Election Attacks, Trump Does Not Let Reality Get in His Way 2026 年 2 月 14 日 Katie Rogers

- Consultants Offered Epstein Access to Top N.Y. Democrats if He Donated 2026 年 2 月 14 日 Jay Root and Bianca Pallaro

- ICE Agents Menaced Minnesota Protesters at Their Homes, Filings Say 2026 年 2 月 14 日 Jonah E. Bromwich

- Trump Administration Tells Judge It Will Release Gateway Funding 2026 年 2 月 13 日 Patrick McGeehan

- Florida Couple Arrested After Pickleball Match Turns Into a Brawl 2026 年 2 月 13 日 Neil Vigdor

Leave a Reply