Tag: outperformance

Stellar’s XLM Rises 3.6%, Breaking Key Resistance Amid Bullish Signals

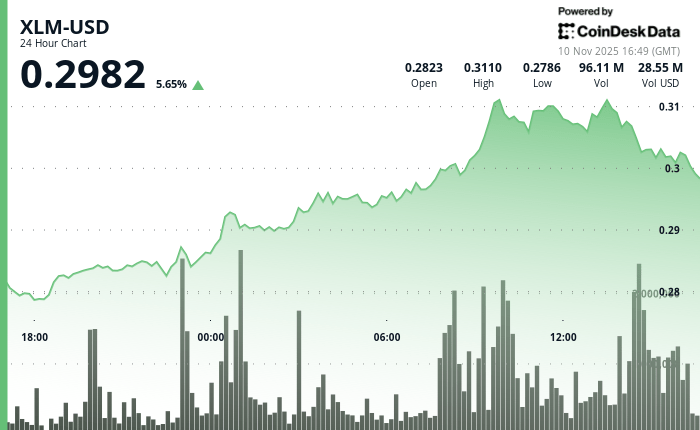

The post Stellar’s XLM Rises 3. 6%, Breaking Key Resistance Amid Bullish Signals appeared com. Stellar’s XLM surged 3. 62% to $0. 3004 on Tuesday, breaking above key resistance as trading volume spiked nearly 19% above its 30-day average. The move outperformed the broader crypto market by 4. 86%, pushing XLM closer to the 5% relative strength threshold that often marks the start of major breakout trends. Trading activity intensified during European hours, with volume peaking at 68. 52 million shares-78% higher than its 24-hour moving average. The strong inflows confirmed a clean breakout through the $0. 3020 resistance level, as XLM consolidated gains between $0. 3020 and $0. 3100, establishing firm support around $0. 3058. Analysts are watching closely as XLM approaches the upper boundary of a seven-year symmetrical triangle pattern. Chartered Market Technician Aksel Kibar notes that price compression since 2018 has created a setup with significant breakout potential, projecting a possible move toward $1. 52-representing a 446% rally from current prices if the token exits its multi-year consolidation. For traders, the focus now shifts to whether XLM can sustain momentum above resistance and confirm a long-term breakout. The surge in institutional participation at the $0. 3020 level and consistent buying on pullbacks signal strengthening demand. Combined with the token’s clear outperformance of the market, these factors suggest XLM could be on the verge of a sustained bullish phase. XLM/USD (TradingView) Key Technical Levels Signal Momentum Shift for XLM Support/Resistance: Primary support established at $0. 3058 with multiple successful tests; resistance formed at $0. 3118 session high with consolidation between $0. 3020-$0. 3100 Volume Analysis: Peak activity of 68. 52M shares (78% above 24-hour SMA) occurred at 09: 00, validating breakout through $0. 3020 resistance level Chart Patterns: Double-wave rally pattern emerged with ascending trend showing higher lows at $0. 2790, $0. 2845, and $0. 2915 across 11. 6% total range Targets & Risk/Reward: Immediate resistance zone at $0. 3045-$0. 3050 with longer-term triangle breakout target at $1. 52 representing 446% upside potential if seven-year pattern resolves.

Gold’s Decline to $3900 Could Signal the Next Big Altcoin Rally, Says Michaël van de Poppe

The post Gold’s Decline to $3900 Could Signal the Next Big Altcoin Rally, Says Michaël van de Poppe appeared com. Gold and Bitcoin are again in the news, as Michael van de Poppe has put into the limelight a major macro trend. The recent decrease in gold, alongside its consolidation, which he says will give rise to altcoins and Bitcoin. I’ve said this yesterday and earlier, Gold coming down and consolidating is heavily bullish for risk-on assets, including #Altcoins. There’s been a negative correlation between TH / TC and Gold. The best period to thrive for altcoins is to have a period of consolidation. pic. twitter. com/KZjWj4LVsq Michaël van de Poppe (@CryptoMichNL) October 28, 2025 Van de Poppe reckons that the fall of such commodities commonly leads to a market shift into more risky assets, such as Bitcoin, Ethereum, and altcoins currently in their early stages of development. Over the last 7 days, gold has decreased in value, dropping from $4,783 to $3,918 since the beginning of the week and testing key support levels at $3,900, which coincides with the EMA50 on the daily timeframe. This downward trend might precondition a long-term phase of crypto market growth as investors are looking for greater profits. Risk-on Momentum Builds Across Bitcoin and Ethereum As Gold Consolidates As gold consolidates, the larger crypto market has risen. Bitcoin was at $105000 last week, and it has risen to a high of $115000 this week, which indicates 9. 5% growth. Similarly, Ethereum surged back and rose from 3, 800 to 4, 200. This indicated a new wave of strength in the big altcoins. As Van de Poppe describes, the ETH/BTC pair has been relatively negatively correlated with gold in the past. This trend tends to recur, with some of the currencies of the altcoins recording a positive growth of up to 15% over the last week. The continued outperformance of the leading digital assets underscores the perception that investors.

The New York Times

The New York Times

- Department of Homeland Security Shuts Down, Though Essential Work Continues 2026 年 2 月 14 日 Madeleine Ngo

- Casey Wasserman Will Sell Entertainment Agency Amid Epstein Files Fallout 2026 年 2 月 14 日 Shawn Hubler, Ben Sisario and Emmanuel Morgan

- New Research Absolves the Woman Blamed for a Dynasty’s Ruin 2026 年 2 月 14 日 Andrew Higgins

- How China Built a Chip Industry, and Why It’s Still Not Enough 2026 年 2 月 14 日 Meaghan Tobin

- ’The Interview’: Gisèle Pelicot Shares Her Story 2026 年 2 月 14 日 Lulu Garcia-Navarro

- Ramping Up Election Attacks, Trump Does Not Let Reality Get in His Way 2026 年 2 月 14 日 Katie Rogers

- Consultants Offered Epstein Access to Top N.Y. Democrats if He Donated 2026 年 2 月 14 日 Jay Root and Bianca Pallaro

- ICE Agents Menaced Minnesota Protesters at Their Homes, Filings Say 2026 年 2 月 14 日 Jonah E. Bromwich

- Trump Administration Tells Judge It Will Release Gateway Funding 2026 年 2 月 13 日 Patrick McGeehan

- Florida Couple Arrested After Pickleball Match Turns Into a Brawl 2026 年 2 月 13 日 Neil Vigdor