Tag: current bitcoin

MicroStrategy Unlikely to Liquidate Bitcoin in Next Bear Market, Analyst Says

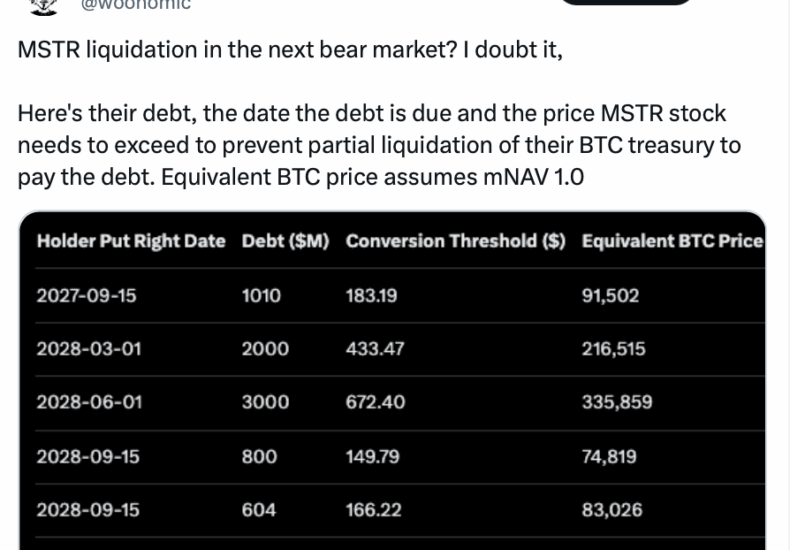

The post MicroStrategy Unlikely to Liquidate Bitcoin in Next Bear Market, Analyst Says appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → MicroStrategy is unlikely to liquidate its Bitcoin holdings in the next bear market, according to analyst Willy Woo, due to its convertible debt structure and current stock valuation thresholds that protect against forced sales even if Bitcoin drops to around $91,500. MicroStrategy’s debt repayment options include cash or stock, avoiding Bitcoin sales if shares stay above $183. 19. Current Bitcoin price at $101,377 provides a buffer against liquidation in moderate downturns. Strategy holds 641, 205 BTC valued at $64 billion, with analysts forecasting resilience unless a severe, sustained bear market occurs. MicroStrategy Bitcoin liquidation risks analyzed: Willy Woo predicts no forced sales in next downturn. Explore debt details, stock thresholds, and BTC holdings for investor insights-stay informed on crypto corporate strategies. What is the Risk of MicroStrategy Liquidating Bitcoin in the Next Bear Market? MicroStrategy Bitcoin liquidation appears highly unlikely in the upcoming bear market, as stated by prominent Bitcoin analyst Willy Woo. The company’s convertible senior notes allow repayment through cash, common stock, or a mix, providing flexibility without needing to sell its substantial Bitcoin reserves. This structure safeguards holdings.

The New York Times

The New York Times

- Epstein Files Reveal Efforts to Build Ties With Russian Officials, Including Putin 2026 年 2 月 10 日 Steven Lee Myers and Nataliya Vasilyeva

- How the Israeli President’s Visit to Australia Created a ‘Tinder Box’ 2026 年 2 月 10 日 Victoria Kim

- A.I. Personalizes the Internet but Takes Away Control 2026 年 2 月 10 日 Brian X. Chen

- Mamdani Hires Groundbreaking Computer Scientist as Chief Tech Officer 2026 年 2 月 10 日 Jeffery C. Mays

- Pride Flag Is Removed From Stonewall Monument After Trump Directive 2026 年 2 月 10 日 Liam Stack, Jonathan Wolfe and Yan Zhuang

- Epstein Used Cash to Wield His Influence at Columbia and N.Y.U. 2026 年 2 月 10 日 Sharon Otterman

- Susan Collins Runs for Re-election, in One of 2026’s Top Senate Fights 2026 年 2 月 10 日 Reid J. Epstein

- Hamas Would Keep Some Weapons Initially in Draft Gaza Plan 2026 年 2 月 10 日 Adam Rasgon, Natan Odenheimer and Abu Bakr Bashir

- The Ties That Bound the UK’s ‘Prince of Darkness’ Peter Mandelson to Jeffrey Epstein 2026 年 2 月 10 日 Michael D. Shear and Jane Bradley

- NLRB Dismisses Case Brought by Fired SpaceX Employees 2026 年 2 月 10 日 Noam Scheiber and Ryan Mac