Tag: cryptocurrency

Crypto News Today: Bitcoin (BTC) Holds Steady Amid Storms As MUTM at $0.035 Brews Its Own Path

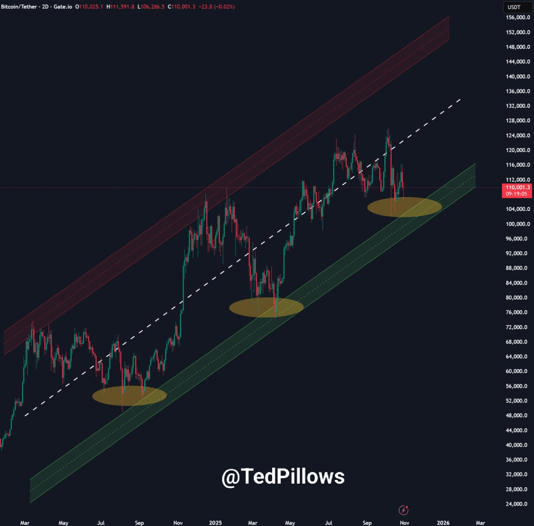

The post Crypto News Today: Bitcoin at $0. 035, to be identified as the best cryptocurrency to buy, with levels offering solutions in DeFi yield unpaved by macro BTC storms, with 17, 700 supporters and $18,400,000 raised. Bitcoin’s Steady Hold Bitcoin was trading close to $110,000, erasing Friday’s Wall Street drops, while data confirms ongoing ETF outflows, showing TradFi sell-offs. Glassnode pointed out ETF outflows of $191 million on Friday, following Thursday’s outflows of $488 million, showing cooling interest even with Fed easing. Trader sentiment has remained weak, with levels of important breakout points identified by ‘Daan Crypto Trades’ at $107,000 and $116,000. The close above $100,000 in the current week will now be critical in preventing a downtrend. MUTM’s V1 Protocol Nears Testnet Launch Mutuum Finance has progressed in their V1 lending platform’s Sepolia testnet launch, moving from conceptualization to the stage of having functional products such as liquidity pools and mtTokens, with the target launch in Q4 2025. The project’s continuous updates have ensured MUTM’s position in the few DeFi projects with deployment-ready platforms. The early supporters have guaranteed their entry into a platform where ETH and USDT facilitate loans and collateral right from day one, with further additions.

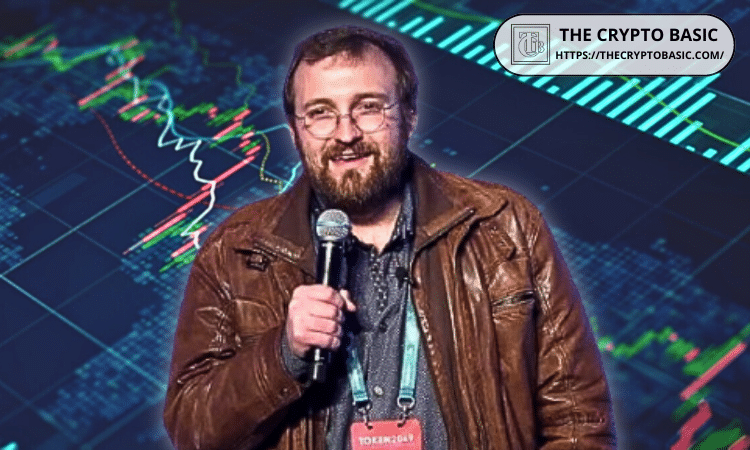

Cardano Founder Blames ADA Users for DeFi Woes: “Our TVL Would Be $5-10 Billion Minimum”

Charles Hoskinson, the founder of the Cardano network, has fired a shot at the ADA community for contributing to their DeFi shortcomings. Notably, he highlighted this in his recent podcast, as he suggested that Cardano users are contributing to the struggles in decentralized finance (DeFi). Visit Website.

EU mulls SEC-like oversight for stock, crypto exchanges to bolster startup landscape

The EU is reportedly drafting a proposal to transfer crypto and financial sector oversight to the ESMA, as part of a wider push to improve capital markets for startups.

XRP Price Prediction: Targeting $3.50-$4.00 by December 2025 as Technical Breakout Looms

XRP price prediction points to $3. 50-$4. 00 targets within 30 days as bullish momentum builds. Current technical setup suggests breakout above $2. 70 resistance could trigger rally. (Read More).

SOL Tests Key $185 Support as Crypto Markets Face November Volatility

The post SOL Tests Key $185 Support as Crypto Markets Face November Volatility appeared com. James Ding Nov 01, 2025 12: 22 Solana trades at $186. 35 after a 1. 4% decline, hovering near critical support levels as traders position for potential breakout above $190 resistance in absence of major catalysts. Quick Take • SOL trading at $186. 35 (down 1. 4% in 24h) • No significant news catalysts driving movement in past 48 hours • Price testing pivot point support around $187 level • Following broader crypto weakness alongside Bitcoin decline Market Events Driving Solana Price Movement Trading on technical factors in absence of major catalysts, SOL price has consolidated in a tight range between $184-190 over the past 24 hours. No significant news events have emerged in the past 48 hours to drive directional momentum for Solana. The current price action reflects broader cryptocurrency market dynamics, with most major tokens experiencing modest declines as November trading begins. Market participants appear to be taking a cautious stance ahead of potential volatility typically associated with the final months of the year. Volume on Binance spot market reached $415. 6 million in the past 24 hours, indicating sustained institutional interest despite the lack of major news flow. This elevated volume suggests traders are actively positioning around current technical levels. SOL Technical Analysis: Consolidation Phase Price Action Context SOL price currently trades below its short-term moving averages, with the 7-day SMA at $192. 14 and 20-day SMA at $191. 32 both acting as immediate resistance. However, the token remains above its 200-day moving average of $179. 26, maintaining its longer-term bullish structure. The current positioning between the $187 pivot point and $191 resistance zone suggests Solana is in a consolidation phase, potentially building energy for the next directional move. Trading volume patterns indicate institutional participants are accumulating on dips rather than selling aggressively. Key Technical Indicators The RSI.

China Sentences Five Over $166 Million in Illegal USDT Currency Conversions

A Chinese court has jailed five defendants for engaging in illegal USDT transactions, citing the need to protect national financial stability.

How Bitcoin Adoption in the U.S. Could Double by 2025—Insights from the Bitcoin Conference

The post How Bitcoin Adoption in the U. S. Could Double by 2025-Insights from the BitcoS. Senator JD Vance made a bold prediction that the number of Americans owning Bitcoin will double from around 50 million to 100 million in the coming years. He described Bitcoin as a symbol of innovation, financial freedom, and a strong hedge against inflation and government overreach, emphasizing that crypto.

Immunefi CEO Warns of Urgent Security Needs in Stablecoin Sector

The post Immunefi CEO Warns of Urgent Security Needs com. Iris Coleman Nov 01, 2025 02: 17 Immunefi CEO Mitchell Amador discusses the urgent need for enhanced security in the rapidly growing stablecoin sector as vulnerabilities pose significant risks. Stablecoin Security Under Scrutiny As stablecoins become increasingly integral to the digital economy, security concerns are mounting. According to a recent interview with Mitchell Amador, CEO of Immunefi, security firms are in a ‘race against time’ to prevent potential billion-dollar exploits in the stablecoin sector. This urgency is driven by the explosive adoption of stablecoins and the concurrent lag in security infrastructure development. High Vulnerability Rates Amador revealed alarming statistics indicating that over 90% of audited projects within the stablecoin ecosystem exhibit critical vulnerabilities. These vulnerabilities could potentially lead to significant financial losses if not addressed promptly. Despite the influx of capital into the stablecoin market, many projects fail to implement essential security measures such as firewalls, leaving them exposed to potential exploits. Challenges in Security Infrastructure The rapid growth of stablecoins has outpaced the development of robust security frameworks necessary to protect these digital assets. As a result, the sector faces substantial risks that could undermine trust and stability in the broader cryptocurrency market. Amador emphasized the need for comprehensive security audits and the implementation of advanced security protocols to safeguard these financial instruments. Broader Implications for the Crypto Market The implications of inadequate security in the stablecoin sector extend beyond individual projects. Stablecoins serve as a financial backbone for the on-chain economy, facilitating transactions and providing liquidity across various platforms. Therefore, any significant breach or exploit could have ripple effects throughout the entire cryptocurrency ecosystem, potentially impacting market stability and investor confidence. For more detailed insights, the full interview with Mitchell Amador can be found on CoinMarketCap. Image source: Shutterstock Source:.

Tether’s Profits Surge Amid Stablecoin Growth and BlackRock’s Market Expansion

The post Tether’s Profits Surge Amid Stablecoin Growth and BlackRock’s Market Expansion appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Stablecoin profitability drives the crypto economy, with issuers like Tether and Circle capturing 60% to 75% of daily protocol revenues by investing reserves in yield-bearing assets such as U. S. Treasuries, generating billions in profits without sharing yields with holders. Tether projects $15 billion in profits for the year with a 99% margin, highlighting exceptional per-employee profitability in the sector. Stablecoins provide stability for liquidity in exchanges, DeFi, and payments, outperforming volatile assets like Bitcoin. Analysts from Citi forecast stablecoin market growth to $4 trillion by decade’s end, up from $280 billion, fueled by institutional involvement from firms like BlackRock. Discover how stablecoin profitability is reshaping crypto revenues, with Tether leading at $15B profits. Learn about issuer strategies and market growth-explore now for investment insights. What Drives Stablecoin Profitability in the Crypto Sector? Stablecoin profitability stems primarily from issuers earning interest on reserves backing their tokens, often invested in low-risk assets like U. S. Treasuries and cash equivalents. Companies such as Tether and Circle retain these yields, creating substantial revenue streams that dominate the crypto landscape. This model has positioned stablecoins.

Bitcoin Price Today: BTC Chops at $109K While Noomez ($NNZ) Presale Prepares for 100x

Bitcoin price today is trending lower, with BTC trading around $109K, reflecting a 0. 3% dip in the past 24 hours. [.] The post Bitcoin Price Today: BTC Chops at $109K While Noomez (NZ) Presale Prepares for 100x appeared first on Coindoo.

The New York Times

The New York Times

- Air Canada Cancels Flights to Cuba as Cuba Runs Out of Jet Fuel 2026 年 2 月 10 日 Frances Robles

- The Epstein Files Are Coming for Keir Starmer 2026 年 2 月 10 日 Moya Lothian-McLean

- Bangladesh Exposed the Deeper Problem Facing Democracy 2026 年 2 月 10 日 Zahid Hussain and Tom Felix Joehnk

- Nicaragua Blocks a Route from Cuba to the U.S. 2026 年 2 月 10 日 James Wagner

- How Italy’s Police and Army Compete to Enlist Italian Olympians 2026 年 2 月 10 日 Jason Horowitz

- New Email Shows Bard President Leon Botstein Thanked Epstein for Caribbean Trip 2026 年 2 月 10 日 Vimal Patel

- Appeals Court Lets Trump Revoke Deportation Protections for 60,000 More Migrants 2026 年 2 月 10 日 Chris Cameron

- Judge Strikes Down California’s Ban on Masks for Federal Agents 2026 年 2 月 10 日 Laurel Rosenhall

- A Campaign to Revoke the Endangerment Finding Appears Near ‘Total Victory’ 2026 年 2 月 10 日 Lisa Friedman and Maxine Joselow

- Trump Threatens to Block Opening of Gordie Howe International Bridge to Canada 2026 年 2 月 10 日 Chris Cameron and Vjosa Isai