Tag: cryptocurrency

Presale Success Amid Downturn: How Ozak AI’s $4.56M Raise Signals a Changing Crypto Investment Landscape

The post Presale Success Amid Downturn: How Ozak AI’s $4. 56M Raise Signals a Changing Crypto Investment Landscape appeared com. The cryptocurrency market is evolving, and AI-based cryptocurrencies are set to dominate it. Investors are now looking for early-stage cryptocurrency projects that can generate massive returns. There are many early-stage cryptos on the market, but Ozak AI is unique among them. Ozak AI’s core technology combines AI and blockchain to create an AI prediction tool capable of analyzing real-time blockchain data. The cryptocurrency market is down, but Ozak AI has raised more than $2. 28 million in presale funding. This clearly demonstrates that investors are turning their attention to AI-based cryptos. The $4. 56M Milestone A Sign of Investor Confidence During the bearish market, crossing $4. 56 million is not just hype; it clearly shows how Ozak AI has gained the investors’ confidence. Currently, the token is in its 7th presale phase, priced at $0. 014. The previous phase closed recently and more than 1 billion tokens have been sold so far. This shows how the token has the capabilities of pulling the investor’s interest, with its presale price. Not only the presale, but the momentum has also been built through the structured tokenomics. The total supply of tokens was 10 billion, with 30% allocated for presale. 10% for liquidity and the team, respectively. 30% for the environment and community. 20% for future reserves. The token allocations and the presale growth show a clear sign of larger price movements. Utility Over Hype The New Investor Mindset For years, hyped tokens and meme-based tokens have dominated the cryptocurrency market. However, the high volatility of these tokens drives investors to look for AI-based tokens. Investors are looking for long-term growth potential in tokens with strong technology backing them. AI is the future of crypto, and AI-based tokens are poised to dominate the cryptocurrency market. Ozak AI has advanced technology with numerous features. Smart Contract.

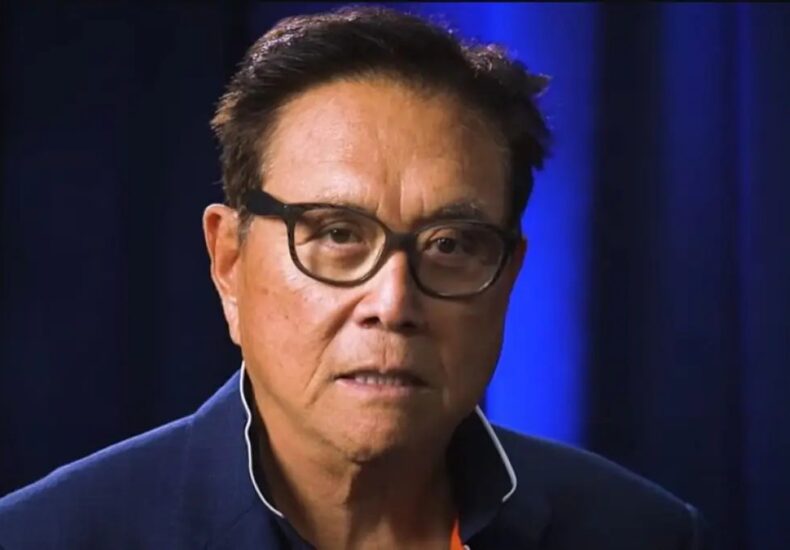

Robert Kiyosaki Bought Bitcoin at $6,000

The post Robert Kiyosaki Bought Bitcoin at $6,000 appeared com. Bitcoin Robert Kiyosaki, investor and author of Rich Dad, Poor Dad, has disclosed that he recently sold a portion of his Bitcoin holdings and reinvested the proceeds into businesses he owns. Key Takeaways: Robert Kiyosaki sold roughly $2. 25 million worth of Bitcoin to reinvest in income-producing businesses. He expects the new ventures to generate about $27, 500 in tax-free monthly cash flow by February 2026. Kiyosaki remains bullish on Bitcoin and plans to buy more using the passive income rather than his savings. According to Kiyosaki, the move was not driven by a loss of confidence in the cryptocurrency market but by a shift in strategy toward increasing recurring income. Early BTC Accumulation Turned Into Business Expansion Kiyosaki stated that the Bitcoin he sold was accumulated several years ago when the price was near $6,000. He exited his position at around $90,000, generating approximately $2. 25 million in proceeds. The capital is now being allocated to two surgery centers and a billboard business that he owns. He estimates that these acquisitions will generate roughly $27, 500 per month in tax-free income beginning in February 2026. Still Bullish on BTC Despite Liquidation Despite liquidating a substantial portion of his Bitcoin, Kiyosaki emphasized that he remains optimistic about the asset. He confirmed that he intends to buy more Bitcoin in the future but plans to do so using income from his newly expanded business operations rather than personal cash reserves. On November 9, he reiterated a price prediction of $250, 000 for Bitcoin by 2026 and a $27, 000 price target for gold. Sale Announced During Height of Market Downturn The announcement came during a period of significant market stress. Bitcoin briefly dropped below $85,000 this week and touched $80,537 before recovering toward $84,000 at the time of writing. The Crypto Fear & Greed Index fell to.

CME, CF Benchmarks to Launch Bitcoin Volatility Indices

Liquid benchmarks are vital market infrastructure and these indices underscore maturity of the bitcoin options market.

Bitrue Revitalizes Flagship Earn Product With New XRP Offer

The post Bitrue Revitalizes Flagship Earn Product With New XRP Offer appeared com. Leading cryptocurrency exchange Bitrue has today announced a revitalization of its staking service by relaunching an XRP investment offer that first debuted in 2019. In an opportunity exclusive for new users who may be finding it difficult to manage recent volatility spikes, new entrants to the cryptocurrency space can now invest their XRP at 6. 8% APR and continue to earn while waiting for the markets to regain stability. This rate mirrors the first offer that Bitrue provided to its users in 2019, when Bitrue became the first cryptocurrency exchange in the world to launch a flexible staking service by offering XRP investments to its users. Such investment offers are now commonplace among all exchanges, showcasing Bitrue’s visionary and innovative approach to digital finance that continues guiding its development to this day. “The recent market downtrend is a familiar sight for multi-year crypto veterans but it’s a tough environment for new users who may not be used to extreme volatilities.” said Adam O’Neill, Chief Marketing Officer at Bitrue. “The relaunch of our classic XRP offer provides a safe-haven for users to park their assets and ride out the storm as best as possible. For users who regret that they didn’t begin investing 10 years ago, we hope that this echo of a previous age will act as a beacon of renewal and encourage people to catch the growth coming over the next decade.” This news comes at a time when XRP is gaining significant institutional level interest, including the ongoing launch of multiple ETFs which are expected to accelerate investment levels over the next several years. On-chain activity is also growing significantly with settlement rates growing by 200% in recent weeks and the number of wallets steadily increasing, suggesting an increasing level of behind the scenes support for the coin. “Signs.

XRP Drops 32% in Volume: Is It Concerning?

XRP saw a sudden drop in spot trading volume after an earlier rise, falling 32% as traders weigh what comes next to the markets.

Peter Brandt Predicts Bitcoin Could Crash 35% to $58,000 – Here’s Why

TLDR Peter Brandt predicts Bitcoin could crash to $58,000, representing a 35% decline from recent levels The veteran trader correctly predicted Bitcoin’s drop below $4,000 in 2018 when it was trading above $10,000 Brandt identifies a “broadening top” pattern and eight consecutive days of lower highs starting November 11 Bitcoin has already dropped 4. 5% in [.] The post Peter Brandt Predicts Bitcoin Could Crash 35% to $58,000 Here’s Why appeared first on CoinCentral.

Bitcoin Miners Make Stunning 777 BTC Net Purchase

The post Bitcoin Miners Make Stunning 777 BTC Net Purchase appeared com. Have you been wondering what Bitcoin miners are really up to during this market volatility? Recent data reveals a surprising trend that could signal important changes ahead for cryptocurrency investors. According to CryptoQuant analyst Crazzyblockk, Bitcoin miners executed a net purchase of 777 BTC over the past seven days, marking a significant shift in their behavior patterns. What Does This Bitcoin Miners Activity Really Mean? When Bitcoin miners change their strategy, the entire market pays attention. These network participants hold substantial influence over supply dynamics. The recent net purchase of 777 BTC represents more than just numbers it indicates a calculated approach to market conditions. Over the past month, these Bitcoin miners demonstrated balanced behavior, selling 6, 048 BTC across 11 days while accumulating 6, 467 BTC during the remaining 19 days. Why Are Bitcoin Miners Suddenly Buying? The shift from selling to accumulation during price declines suggests several important factors: Miners may believe current prices represent good value Operational costs have become more manageable Long-term confidence in Bitcoin’s fundamentals remains strong Strategic positioning for potential future price increases This behavior from Bitcoin miners contrasts sharply with panic selling, instead reflecting a measured, strategic approach to portfolio management. How Could This Impact Bitcoin Prices? When Bitcoin miners reduce selling pressure, several positive effects can emerge. First, decreased selling from major holders helps stabilize prices. Second, accumulation signals confidence to other market participants. Third, reduced circulating supply can create better conditions for price appreciation. The actions of these Bitcoin miners often serve as leading indicators for market sentiment. What Challenges Do Bitcoin Miners Face? Despite the optimistic signals, Bitcoin miners operate in a complex environment. They must balance: Energy costs and operational efficiency Market volatility and price swings Network difficulty adjustments Regulatory considerations across jurisdictions The fact that Bitcoin miners are net.

Critical Market Signal Reveals What’s Next For BTC Price

The post Critical Market Signal Reveals What’s Next For BTC Price appeared com. Bitcoin investors are facing a critical moment as the world’s largest cryptocurrency enters oversold territory. The recent market movements have pushed Bitcoin’s technical indicators into concerning levels, raising important questions about what comes next for BTC price action. Understanding what Bitcoin oversold conditions mean could help traders navigate these volatile waters. What Does Bitcoin Oversold Actually Mean? When analysts say Bitcoin is oversold, they’re referring to the Relative Strength Index (RSI) dropping below 30. This technical indicator measures the speed and change of price movements. The current 14-day RSI reading suggests that selling pressure has pushed Bitcoin to potentially unsustainable levels. However, being oversold doesn’t guarantee an immediate rebound it simply indicates that the asset may be due for some form of correction or consolidation. How Serious Is This Bitcoin Oversold Condition? The current Bitcoin oversold situation carries significant weight for several reasons: Historical patterns show similar RSI drops preceded major price bottoms The February precedent saw BTC eventually form a bottom at $75,000 Market sentiment has turned noticeably bearish Trading volume patterns suggest institutional caution This combination of factors creates a complex scenario where short-term pain could potentially lead to long-term gain for patient investors. Will Bitcoin Rebound or Continue Declining? Market analysts are divided on the immediate outlook for Bitcoin. The Bitcoin oversold condition typically suggests one of two outcomes. First, we might see a sideways movement period where the market consolidates and builds a new foundation. Alternatively, a sharp rebound could occur if positive catalysts emerge. However, most experts caution that downward pressure may persist before any significant recovery begins. What Historical Patterns Tell Us About Bitcoin Oversold Phases Looking back at previous Bitcoin oversold periods reveals valuable insights. The late February instance where RSI dropped below 30 resulted in Bitcoin finding support two months later.

Bitcoin News: Strategy’s $835 Million Bitcoin Acquisition Marks Largest Purchase Since July

The post Bitcoin News: Strategy’s $835 Millicom. Key Insights: Bitcoin news broke as Strategy announced an $835 million acquisition of 8, 178 BTC on November 17. The purchase represented the firm’s most significant Bitcoin-denominated buy since July 29 and pushed total holdings to 649, 870 BTC. Strategy now controls approximately 3. 1% of Bitcoin’s total circulating supply amid ongoing mNAV compression. Strategy disclosed on November 17 that it acquired 8, 178 BTC for approximately $835 million, marking its most substantial single purchase since July 29, when the firm bought 21, 021 coins. The Virginia-based company’s total cost basis reached $48. 37 billion following the transaction, with an average acquisition price of $74,430 per coin across all holdings. Strategy’s Bitcoin treasury now stood at 649, 870 BTC, equivalent to roughly 3. 1% of the cryptocurrency’s maximum supply. Bitcoin News: Purchase Arrives Amid Sub-1. 0 mNAV Trading The aggressive accumulation occurred while Strategy’s stock traded at a discount to its underlying Bitcoin holdings. At press time, MSTR shares reflected an mNAV of 0. 93, meaning investors valued the stock below the company’s net asset value. Strategy’s mNAV first breached 1. 0 on November 13 when shares traded at $222. 31, declining 1. 2% in early trading. Bitcoin Treasuries data recorded the mNAV at 0. 977 that day, marking the first instance the firm traded below net asset value since January 11, 2024. The development represented a fundamental shift in how markets valued digital asset treasury companies. The premium that MSTR stock commanded over its Bitcoin reserves evaporated as investor sentiment shifted amid tightening liquidity and broader pressure in the crypto industry. 75 and $249. 56. The transactions generated approximately $2. 58 million in proceeds.

Shiba Inu (SHIB) Volume Hits Near-Zero Levels: Next Step Is Worse

The post Shiba Inu (SHIB) Volume Hits Near-Zero Levels: Next Step Is Worse appeared com. Nothing left for SHIB Volume being lost Shiba Inu is about to enter one of the riskiest stages a cryptocurrency asset can go through: apathy rather than a crash. Although the price is not plummeting sharply, something much worse is going on below the surface: market participation is almost completely disappearing, volume is evaporating and liquidity is drying up. Nothing left for SHIB A meme asset ceases to exist when it is no longer moving. This is painfully obvious from the chart. All major moving averages, including the 50-day, 100-day and particularly the 200-day MA, are acting as layered resistance, and SHIB is trapped below them. SHIB/USDT Chart by TradingView The price action shows an attempt at a bounce that was unsuccessful in breaking the structure, followed by a gradual decline that is currently centered on $0. 0000090-$0. 0000093. The RSI is in the 39-41 range. It is not strong enough to indicate a buildup, nor is it oversold enough for a reversal. To put it another way, there are no catalysts, no momentum and no volatility. Volume being lost The more significant issue is that the volume is continuously dropping. Recent candles are getting smaller and fading toward historical lows. Every SHIB investor should be much more concerned about that than about a day with a red price. Low volume indicates fewer purchasers, less vendors, no strain on liquidity, absence of speculative interest and a lack of volatility to spur growth. You Might Also Like This is how markets pass away quietly rather than violently. Statistically speaking, the next step is worse: an acceleration of the downtrend, not due to selling pressure but rather because no one is interested in purchasing dips anymore. Even tiny sell orders can cause the price to drop during this phase. Two things would bring SHIB.

The New York Times

The New York Times

- Air Canada Cancels Flights to Cuba as Cuba Runs Out of Jet Fuel 2026 年 2 月 10 日 Frances Robles

- The Epstein Files Are Coming for Keir Starmer 2026 年 2 月 10 日 Moya Lothian-McLean

- Bangladesh Exposed the Deeper Problem Facing Democracy 2026 年 2 月 10 日 Zahid Hussain and Tom Felix Joehnk

- Nicaragua Blocks a Route from Cuba to the U.S. 2026 年 2 月 10 日 James Wagner

- How Italy’s Police and Army Compete to Enlist Italian Olympians 2026 年 2 月 10 日 Jason Horowitz

- New Email Shows Bard President Leon Botstein Thanked Epstein for Caribbean Trip 2026 年 2 月 10 日 Vimal Patel

- Appeals Court Lets Trump Revoke Deportation Protections for 60,000 More Migrants 2026 年 2 月 10 日 Chris Cameron

- Judge Strikes Down California’s Ban on Masks for Federal Agents 2026 年 2 月 10 日 Laurel Rosenhall

- A Campaign to Revoke the Endangerment Finding Appears Near ‘Total Victory’ 2026 年 2 月 10 日 Lisa Friedman and Maxine Joselow

- Trump Threatens to Block Opening of Gordie Howe International Bridge to Canada 2026 年 2 月 10 日 Chris Cameron and Vjosa Isai