Tag: coinmarketcap

Ethena Labs Withdraws ENA Tokens, Raises Market Questions

The post Ethena Labs Withdraws ENA Tokens, Raises Market Questions appeared com. Key Points: Ethena Labs pulls $88. 67M ENA from exchanges, market remains uncertain. No public commentary from Ethena Labs’ leadership. On-chain data shows significant asset relocation without explanation. Ethena Labs has withdrawn 125. 35 million ENA tokens, worth approximately $34. 15 million, from Coinbase Prime and Bybit on November 26, as monitored by Onchain Lens. The substantial withdrawal of ENA, amounting to $88. 67 million in private wallets, raises questions about potential market implications, yet Ethena Labs has made no official statements regarding the activity. Ethena’s $88. 67M ENA Token Withdrawal Raises Speculation Ethena Labs transferred $28. 7 million from Coinbase Prime and $5. 45 million from Bybit to newly established wallets “0xa19” and “0x631”, respectively. These movements, observed by Onchain Lens, marked a total withdrawal of 305. 15 million ENA. However, there are no official statements from Ethena Labs regarding these actions, culminating in heightened market speculation. Though the market is observing these movements, the leadership at Ethena Labs remains silent on the matter. Liquidity for ENA on affected exchanges has declined, yet no updates have been provided by the platforms involved. No official statements have been made regarding the recent ENA withdrawals. Guy Young, CEO, Ethena Labs Lack of transparency from Ethena Labs is generating mixed reactions within the community, as well as from industry observers. Some traders and analysts have started questioning the long-term stability of ENA without direct guidance or reassurance from the project’s leadership. The absence of any formal remarks is fueling uncertainty regarding the potential motives and implications behind these withdrawals. Potential Regulatory Scrutiny Amidst ENA Token Movement Did you know? In December 2024, ENA had seen an unexpected surge after a similar unexplained withdrawal, reflecting how unforeseen movements can influence market perceptions significantly. The current data from CoinMarketCap highlights Ethena’s substantial market stance. Ethena’s (ENA) token is priced at $0. 28.

XRP Drops 32% in Volume: Is It Concerning?

XRP saw a sudden drop in spot trading volume after an earlier rise, falling 32% as traders weigh what comes next to the markets.

Fidelity Launches Solana ETF Amid Rising Institutional Competition

The post Fidelity Launches Solana ETF Amid Rising Institutional Competition appeared com. Key Points: Fidelity is launching the FSOL ETF with a 0. 25% management fee. Intense competition in the Solana ETF space. Industry analysts predict significant interest in FSOL. Fidelity Investments is set to launch its Solana ETF, FSOL, on November 18, 2025, marking an escalation in the competitive landscape for Solana-based ETFs. The launch signals intensified institutional interest in Solana, potentially influencing market dynamics and drawing significant capital inflows amid competitive pressures from existing players like Bitwise and Grayscale. Fidelity’s Market Entry Sparks Solana ETF Rivalry Fidelity Investments is launching the FSOL ETF on November 18, 2025, aiming to capture investor interest in Solana. With a low management fee of 0. 25%, the firm seeks to position itself attractively in the burgeoning Solana ETF landscape. Fidelity’s entry underscores the intensified competitive environment, following launches by other major firms like Bitwise with their SOL and the recent debut of SOL. Institutional competition is amplifying as multiple asset managers enter the Solana ETF space, although major player BlackRock remains uninvolved. Grayscale and VanEck are among those expanding into this sector, contributing to the heightened sense of rivalry. The immediate implications involve strategic fee positioning and staking opportunities, which are likely to impact investor decisions. His statement suggests a pivotal moment for Solana investment products. Market reactions have been largely optimistic, with social media reflecting positive sentiment and robust engagement from both retail traders and institutional entities. Solana’s Price and Market Dynamics Ahead of ETF Launch Did you know? The launch of Bitcoin ETFs led to a surge in BTC’s price during 2021-2024, demonstrating impactful precedent that could follow with Solana’s ETF debut. As of November 18, 2025, Solana (SOL) is priced at $131. 24 with a market.

JPMorgan Chase and DBS Bank to Develop Unique Blockchain Framework with 24/7 Transactions

The post JPMorgan Chase and DBS Bank to Develop Unique Blockchain Framework with 24/7 Transactions appeared com. JPMorgan Chase, a leading financial institution, has partnered with DBS Bank, a multinational banking firm in Singapore. The main objective of this partnership is to develop a unique blockchain framework that will enable 24/7 transactions. LATEST: 🏦 JPMorgan and DBS Bank are developing a blockchain framework for instant 24/7 transfers between their deposit token ecosystems across both public and permissioned networks. pic. twitter. com/hNPE1lU8jq CoinMarketCap (@CoinMarketCap) November 12, 2025 As per CoinMarketCap, the development denotes a landmark in decentralized finance by merging with public networks. With the blockchain technology’s integration into cross-ecosystem payments, the partnership is poised to lead toward borderless, reliable, and faster payments. JPMorgan-DBS Partnership Introduces Institutional Blockchain Framework for Robust 24/7 Transactions The partnership between JPMorgan Chase and DBS Bank is aimed at the development of a new blockchain framework. It will be devoted to the provision of 24/7 transfers, promoting transparency, transfer efficiency, and trust. Additionally, the move also highlights the growing adoption of blockchain innovation among the traditional financial ecosystem. The initiative takes into account the launch of deposit token, JPM Coin, for institutional users through the Base Blockchain. This improves payment efficiency with 24/7 transactions. The launch also underscores a key shift in the wider digital finance, enabling real-time settlements while also driving blockchain expansion within institutional finance. This will permit rapider and cost-effective institutional payments, indicating the rising interest in cutting-edge tokenization solutions. Hence, the duo attempts to set a next-gen industry benchmark for digital payments across banks. According to CoinMarketCap, the tokenization framework of JPMorgan and DBS Bank will let the financial giants offer instant payments without time restrictions. As a result of.

Coinbase adds ASTER to roadmap – Here’s why traders are watching the timing!

Key Takeaways Why is ASTER showing strength despite Q4 losses? ASTER is consolidating around the $1 psychological level, supported by whale accumulation and a carved solid floor, signaling structurThe post Coinbase adds ASTER to roadmap Here’s why traders are watching the timing! appeared first on AMBCrypto.

XRP Price Analysis for November 5

XRP Price Analysis for November 5

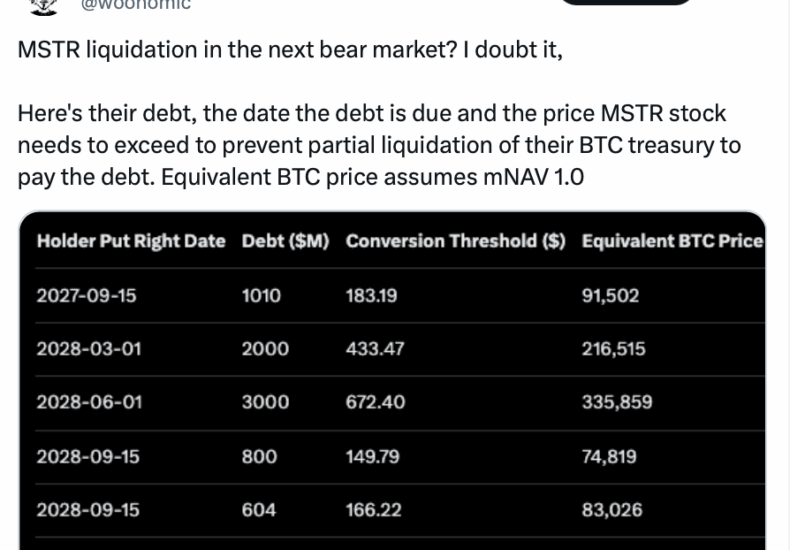

MicroStrategy Unlikely to Liquidate Bitcoin in Next Bear Market, Analyst Says

The post MicroStrategy Unlikely to Liquidate Bitcoin in Next Bear Market, Analyst Says appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → MicroStrategy is unlikely to liquidate its Bitcoin holdings in the next bear market, according to analyst Willy Woo, due to its convertible debt structure and current stock valuation thresholds that protect against forced sales even if Bitcoin drops to around $91,500. MicroStrategy’s debt repayment options include cash or stock, avoiding Bitcoin sales if shares stay above $183. 19. Current Bitcoin price at $101,377 provides a buffer against liquidation in moderate downturns. Strategy holds 641, 205 BTC valued at $64 billion, with analysts forecasting resilience unless a severe, sustained bear market occurs. MicroStrategy Bitcoin liquidation risks analyzed: Willy Woo predicts no forced sales in next downturn. Explore debt details, stock thresholds, and BTC holdings for investor insights-stay informed on crypto corporate strategies. What is the Risk of MicroStrategy Liquidating Bitcoin in the Next Bear Market? MicroStrategy Bitcoin liquidation appears highly unlikely in the upcoming bear market, as stated by prominent Bitcoin analyst Willy Woo. The company’s convertible senior notes allow repayment through cash, common stock, or a mix, providing flexibility without needing to sell its substantial Bitcoin reserves. This structure safeguards holdings.

DOGE Price Analysis for October 31

DOGE Price Analysis for October 31

Novastro Token XNL Plunges Post-Public Sale

The post Novastro Token XNL Plunges Post-Public Sale appeared com. Key Points: Novastro’s token XNL dropped 75% post-TGE, raising concerns. Public sale participants facing 75% value loss. Community questions Kaito AI’s responsibility in vetting projects. Novastro’s XNL token, launched on Kaito AI, plunged 75% below its public sale price to $0. 0126 just two days after its TGE, raising concerns about platform oversight and investor losses. The sharp decline in XNL’s value highlights potential inadequacies in the due diligence processes of fundraising platforms like Kaito AI, affecting investor confidence and sparking community scrutiny. Despite the optimistic start, the token dropped significantly after its TGE, losing over 75% in value within days. Community members have raised concerns about the lack of transparency from Novastro, emphasizing the absence of public statements from its leadership team. Kaito AI, led by CEO Yu Hu, has not issued a statement addressing these losses or their due diligence processes. Prominent crypto voices have highlighted this fall, with KOL AB Kuai. Dong noting it as a rare occurrence for tokens to dip below offering prices post-launch. Kaito AI’s public offering project Novastro opened with a drop of approximately 44% below its initial offering price. becoming one of the few projects recently to fall below its offering price after listing. AB Kuai. Dong, Crypto KOL, Odaily Kaito AI’s public offering project Novastro opened with a drop of approximately 44% below its initial offering price. becoming one of the few projects recently to fall below its offering price after listing. AB Kuai. Dong, Crypto KOL, Odaily Market Experts Cite Lack of Major Exchange Listings for Volatility Did you know? Novastro’s rapid value decline is reminiscent of similar RWA token falls between 2023-2025, where ambitious.

Security Breach at 402Bridge Initiated by Private Key Leak

The post Security Breach at 402Bridge Initiated by Private Key Leak appeared com. Key Points: 402Bridge breach linked to private key leak, insider suspicion remains. Stolen funds moved to Arbitrum, no further transactions. First major security incident for 402Bridge, prompting safety concerns. The 402Bridge project experienced a security breach, traced to a private key leak, potentially involving insider actions, resulting in the theft of approximately 4. 2 ETH transferred to Arbitrum. This incident marks the first major security breach for 402Bridge, highlighting persistent vulnerabilities in cross-chain bridge protocols and raising concerns about insider threats in the cryptocurrency sector. Private Key Leak at 402Bridge Raises Insider Concerns SlowMist’s analysis reveals that the attack on 402Bridge stemmed from a private key leak, leaving insider involvement a possibility. The project’s domain was registered only two days before shutting down, suggesting suspicious preparations. Market observers note that no major statements from project leaders or government bodies are available. The stolen funds have been moved to the Arbitrum network, but no further transfers have been detected. This incident marks a significant challenge in maintaining security in the industry. “The 402Bridge attack appears to have originated from a private key leak, and the possibility of insider involvement cannot be ruled out.” Cosine, Analyst, SlowMist Lessons from Past Cross-Chain Breaches Impacting DeFi Did you know? The 402Bridge incident is part of over 49 recorded cross-chain breaches in the past three years, most stem from similar vulnerabilities like private key leaks and contract flaws. Ethereum, traded as ETH, currently stands at $4,098. 38 with a market cap of $494. 67 billion, accounting for 12. 86% of the market. In the past 24 hours, trading volume reached $38. 37 billion, reflecting an 11. 15% change, as listed on CoinMarketCap. Ethereum(ETH), daily chart, screenshot on CoinMarketCap at 04: 44 UTC on October 28, 2025.

The New York Times

The New York Times

- Two Missouri Deputies Are Killed After Traffic Stop in Christian County 2026 年 2 月 24 日 Billy Witz

- Ukraine Battlefield Dead Could Reach 500,000 in Fifth Year, Estimates Suggest 2026 年 2 月 24 日 Paul Sonne and Constant Méheut

- Snowball Fight in New York Turns Chaotic After Police Arrive 2026 年 2 月 24 日 Maia Coleman

- D.O.J. Sues U.C.L.A. After It Refused to Pay $1 Billion Fine 2026 年 2 月 24 日 Alan Blinder and Anemona Hartocollis

- Trump’s New Tariffs Could Face Legal Challenges 2026 年 2 月 24 日 Ana Swanson and Tony Romm

- Home Depot Says Homeowners Are Weary From Economic Pressures 2026 年 2 月 24 日 Kim Bhasin

- Is It Safe to Travel to Mexico Right Now, Given the Cartel Violence? 2026 年 2 月 24 日 Shannon Sims

- Racing to Catch Up With Nvidia, AMD Signs Chips-for-Stock Deal With Meta 2026 年 2 月 24 日 Tripp Mickle and Adam Satariano

- 15 States Sue H.H.S. Over Revisions to Vaccine Schedule 2026 年 2 月 24 日 Apoorva Mandavilli

- Trump Leans on Congress to Address His False Claims of Voter Fraud 2026 年 2 月 24 日 Michael Gold