Tag: chartered market technician aksel kibar

Stellar’s XLM Rises 3.6%, Breaking Key Resistance Amid Bullish Signals

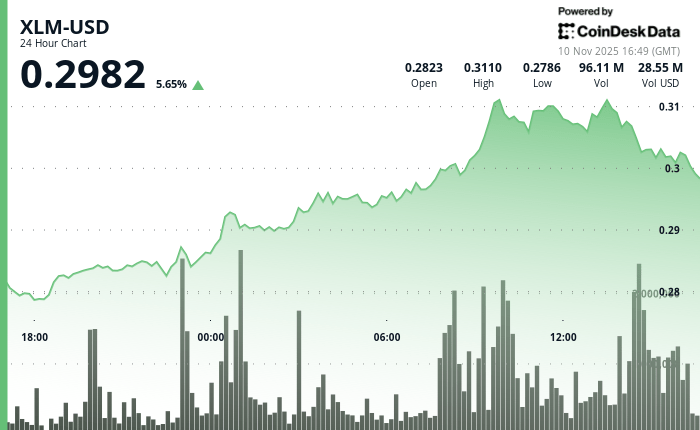

The post Stellar’s XLM Rises 3. 6%, Breaking Key Resistance Amid Bullish Signals appeared com. Stellar’s XLM surged 3. 62% to $0. 3004 on Tuesday, breaking above key resistance as trading volume spiked nearly 19% above its 30-day average. The move outperformed the broader crypto market by 4. 86%, pushing XLM closer to the 5% relative strength threshold that often marks the start of major breakout trends. Trading activity intensified during European hours, with volume peaking at 68. 52 million shares-78% higher than its 24-hour moving average. The strong inflows confirmed a clean breakout through the $0. 3020 resistance level, as XLM consolidated gains between $0. 3020 and $0. 3100, establishing firm support around $0. 3058. Analysts are watching closely as XLM approaches the upper boundary of a seven-year symmetrical triangle pattern. Chartered Market Technician Aksel Kibar notes that price compression since 2018 has created a setup with significant breakout potential, projecting a possible move toward $1. 52-representing a 446% rally from current prices if the token exits its multi-year consolidation. For traders, the focus now shifts to whether XLM can sustain momentum above resistance and confirm a long-term breakout. The surge in institutional participation at the $0. 3020 level and consistent buying on pullbacks signal strengthening demand. Combined with the token’s clear outperformance of the market, these factors suggest XLM could be on the verge of a sustained bullish phase. XLM/USD (TradingView) Key Technical Levels Signal Momentum Shift for XLM Support/Resistance: Primary support established at $0. 3058 with multiple successful tests; resistance formed at $0. 3118 session high with consolidation between $0. 3020-$0. 3100 Volume Analysis: Peak activity of 68. 52M shares (78% above 24-hour SMA) occurred at 09: 00, validating breakout through $0. 3020 resistance level Chart Patterns: Double-wave rally pattern emerged with ascending trend showing higher lows at $0. 2790, $0. 2845, and $0. 2915 across 11. 6% total range Targets & Risk/Reward: Immediate resistance zone at $0. 3045-$0. 3050 with longer-term triangle breakout target at $1. 52 representing 446% upside potential if seven-year pattern resolves.

The New York Times

The New York Times

- What We Know About the Kidnapping of Nancy Guthrie, Savannah Guthrie’s Mother 2026 年 2 月 14 日 Claire Moses

- Thousands Rally for Iran Regime Change in Cities Around the World 2026 年 2 月 14 日 Sanam Mahoozi, Jonathan Wolfe and Abdi Latif Dahir

- Trump Erased the Endangerment Finding. Here Come the Lawsuits. 2026 年 2 月 14 日 Karen Zraick

- How ICE Is Pushing Tech Companies to Identify Protesters 2026 年 2 月 14 日 Sheera Frenkel, Christina Thornell, Valentina Caval, Thomas Vollkommer, Jon Hazell and June Kim

- Navalny Was Poisoned With Frog Toxin, European Governments Say 2026 年 2 月 14 日 Anton Troianovski, Nataliya Vasilyeva and Lynsey Chutel

- The Sea Took Her Prosthetic Leg. Months Later, It Gave It Back. 2026 年 2 月 14 日 Isabella Kwai

- Open Road 2026 年 2 月 14 日 Melissa Kirsch

- New U.S. Boat Strike Kills 3 in the Caribbean 2026 年 2 月 14 日 Carol Rosenberg

- How Former N.Y.C. Schools Chief Joel Klein Became Friendly With Epstein 2026 年 2 月 14 日 Dana Goldstein

- Welcome to the Voyage of the Damned 2026 年 2 月 14 日 Maureen Dowd