Tag: bitcoin

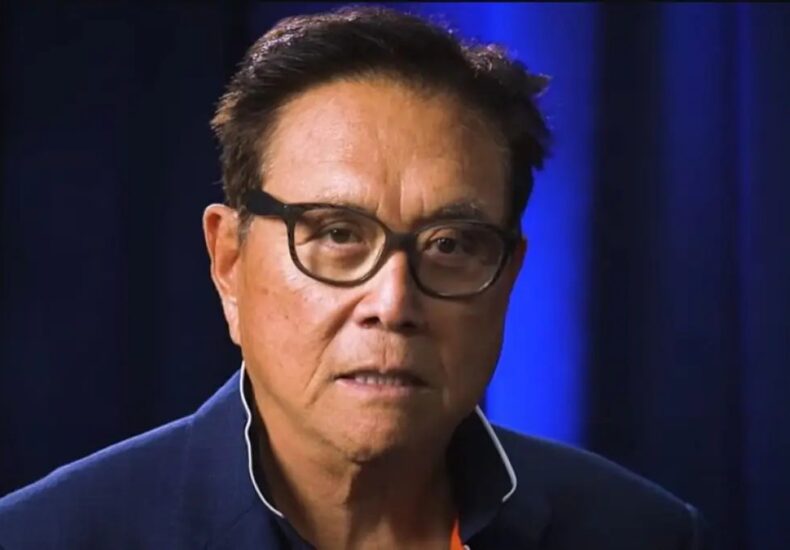

Robert Kiyosaki Bought Bitcoin at $6,000

The post Robert Kiyosaki Bought Bitcoin at $6,000 appeared com. Bitcoin Robert Kiyosaki, investor and author of Rich Dad, Poor Dad, has disclosed that he recently sold a portion of his Bitcoin holdings and reinvested the proceeds into businesses he owns. Key Takeaways: Robert Kiyosaki sold roughly $2. 25 million worth of Bitcoin to reinvest in income-producing businesses. He expects the new ventures to generate about $27, 500 in tax-free monthly cash flow by February 2026. Kiyosaki remains bullish on Bitcoin and plans to buy more using the passive income rather than his savings. According to Kiyosaki, the move was not driven by a loss of confidence in the cryptocurrency market but by a shift in strategy toward increasing recurring income. Early BTC Accumulation Turned Into Business Expansion Kiyosaki stated that the Bitcoin he sold was accumulated several years ago when the price was near $6,000. He exited his position at around $90,000, generating approximately $2. 25 million in proceeds. The capital is now being allocated to two surgery centers and a billboard business that he owns. He estimates that these acquisitions will generate roughly $27, 500 per month in tax-free income beginning in February 2026. Still Bullish on BTC Despite Liquidation Despite liquidating a substantial portion of his Bitcoin, Kiyosaki emphasized that he remains optimistic about the asset. He confirmed that he intends to buy more Bitcoin in the future but plans to do so using income from his newly expanded business operations rather than personal cash reserves. On November 9, he reiterated a price prediction of $250, 000 for Bitcoin by 2026 and a $27, 000 price target for gold. Sale Announced During Height of Market Downturn The announcement came during a period of significant market stress. Bitcoin briefly dropped below $85,000 this week and touched $80,537 before recovering toward $84,000 at the time of writing. The Crypto Fear & Greed Index fell to.

Tom Lee Reveals Why Bitcoin, Ethereum And XRP Are Crashing So Hard

The post Tom Lee Reveals Why Bitcoin, Ethereum And XRP Are Crashing So Hard appeared com. The post Tom Lee Reveals Why Bitcoin, Ethereum And XRP Are Crashing So Hard appeared first The total crypto market cap has erased billions within hours, falling more than 7%. Market analyst Tom Lee, co-founder of Fundstrat, explained on CNBC what is happening behind the scenes and why this crash may be tied to deeper issues in crypto liquidity. A Hidden Shock Hit the Market in October Lee says the downturn began on October 10 when a major automated liquidation event shook the crypto ecosystem. A stablecoin on one exchange briefly fell from 1 dollar to 65 cents because of low liquidity. The sudden drop triggered a chain reaction: Thousands of trading accounts were automatically liquidated Market makers suffered heavy losses Liquidity thinned across several exchanges Lee describes market makers as the central bank of crypto. When they lose money and pull back, the market becomes extremely fragile. Market Makers Are Struggling To Recover After the October shock, major market makers began repairing their balance sheets. This has caused: Less liquidity Wider spreads More forced selling Faster crashes when prices fall Lee compares it to 2022 when a similar wave of liquidations took about eight weeks to clear. He says we are six weeks into a similar cycle right now. A Software Bug Started the Cascade Lee confirms that the problem began with a software bug. The exchange used its own internal price feed instead of multiple sources. When the price briefly broke, an auto deleveraging system liquidated accounts that should not have been touched. The error wiped out nearly two million accounts in minutes. Why Bitcoin,.

MSTR Stock Slumps to $173.55 as Bitcoin Dips Below $88,000

TLDR MSTR stock dropped to $173. 55, marking a new 52-week low for the company. The stock briefly bounced to $176 but stayed near its lowest yearly range. MSTR stock has fallen 40 percent in 2025 and over 62 percent in the past year. Strategy has not yet completed its full common stock issuance plan. The [.] The post MSTR Stock Slumps to $173. 55 as Bitcoin Dips Below $88,000 appeared first on Blockonomi.

Peter Brandt Predicts Bitcoin Could Crash 35% to $58,000 – Here’s Why

TLDR Peter Brandt predicts Bitcoin could crash to $58,000, representing a 35% decline from recent levels The veteran trader correctly predicted Bitcoin’s drop below $4,000 in 2018 when it was trading above $10,000 Brandt identifies a “broadening top” pattern and eight consecutive days of lower highs starting November 11 Bitcoin has already dropped 4. 5% in [.] The post Peter Brandt Predicts Bitcoin Could Crash 35% to $58,000 Here’s Why appeared first on CoinCentral.

Bitcoin Miners Make Stunning 777 BTC Net Purchase

The post Bitcoin Miners Make Stunning 777 BTC Net Purchase appeared com. Have you been wondering what Bitcoin miners are really up to during this market volatility? Recent data reveals a surprising trend that could signal important changes ahead for cryptocurrency investors. According to CryptoQuant analyst Crazzyblockk, Bitcoin miners executed a net purchase of 777 BTC over the past seven days, marking a significant shift in their behavior patterns. What Does This Bitcoin Miners Activity Really Mean? When Bitcoin miners change their strategy, the entire market pays attention. These network participants hold substantial influence over supply dynamics. The recent net purchase of 777 BTC represents more than just numbers it indicates a calculated approach to market conditions. Over the past month, these Bitcoin miners demonstrated balanced behavior, selling 6, 048 BTC across 11 days while accumulating 6, 467 BTC during the remaining 19 days. Why Are Bitcoin Miners Suddenly Buying? The shift from selling to accumulation during price declines suggests several important factors: Miners may believe current prices represent good value Operational costs have become more manageable Long-term confidence in Bitcoin’s fundamentals remains strong Strategic positioning for potential future price increases This behavior from Bitcoin miners contrasts sharply with panic selling, instead reflecting a measured, strategic approach to portfolio management. How Could This Impact Bitcoin Prices? When Bitcoin miners reduce selling pressure, several positive effects can emerge. First, decreased selling from major holders helps stabilize prices. Second, accumulation signals confidence to other market participants. Third, reduced circulating supply can create better conditions for price appreciation. The actions of these Bitcoin miners often serve as leading indicators for market sentiment. What Challenges Do Bitcoin Miners Face? Despite the optimistic signals, Bitcoin miners operate in a complex environment. They must balance: Energy costs and operational efficiency Market volatility and price swings Network difficulty adjustments Regulatory considerations across jurisdictions The fact that Bitcoin miners are net.

Critical Market Signal Reveals What’s Next For BTC Price

The post Critical Market Signal Reveals What’s Next For BTC Price appeared com. Bitcoin investors are facing a critical moment as the world’s largest cryptocurrency enters oversold territory. The recent market movements have pushed Bitcoin’s technical indicators into concerning levels, raising important questions about what comes next for BTC price action. Understanding what Bitcoin oversold conditions mean could help traders navigate these volatile waters. What Does Bitcoin Oversold Actually Mean? When analysts say Bitcoin is oversold, they’re referring to the Relative Strength Index (RSI) dropping below 30. This technical indicator measures the speed and change of price movements. The current 14-day RSI reading suggests that selling pressure has pushed Bitcoin to potentially unsustainable levels. However, being oversold doesn’t guarantee an immediate rebound it simply indicates that the asset may be due for some form of correction or consolidation. How Serious Is This Bitcoin Oversold Condition? The current Bitcoin oversold situation carries significant weight for several reasons: Historical patterns show similar RSI drops preceded major price bottoms The February precedent saw BTC eventually form a bottom at $75,000 Market sentiment has turned noticeably bearish Trading volume patterns suggest institutional caution This combination of factors creates a complex scenario where short-term pain could potentially lead to long-term gain for patient investors. Will Bitcoin Rebound or Continue Declining? Market analysts are divided on the immediate outlook for Bitcoin. The Bitcoin oversold condition typically suggests one of two outcomes. First, we might see a sideways movement period where the market consolidates and builds a new foundation. Alternatively, a sharp rebound could occur if positive catalysts emerge. However, most experts caution that downward pressure may persist before any significant recovery begins. What Historical Patterns Tell Us About Bitcoin Oversold Phases Looking back at previous Bitcoin oversold periods reveals valuable insights. The late February instance where RSI dropped below 30 resulted in Bitcoin finding support two months later.

Bitcoin News: Strategy’s $835 Million Bitcoin Acquisition Marks Largest Purchase Since July

The post Bitcoin News: Strategy’s $835 Millicom. Key Insights: Bitcoin news broke as Strategy announced an $835 million acquisition of 8, 178 BTC on November 17. The purchase represented the firm’s most significant Bitcoin-denominated buy since July 29 and pushed total holdings to 649, 870 BTC. Strategy now controls approximately 3. 1% of Bitcoin’s total circulating supply amid ongoing mNAV compression. Strategy disclosed on November 17 that it acquired 8, 178 BTC for approximately $835 million, marking its most substantial single purchase since July 29, when the firm bought 21, 021 coins. The Virginia-based company’s total cost basis reached $48. 37 billion following the transaction, with an average acquisition price of $74,430 per coin across all holdings. Strategy’s Bitcoin treasury now stood at 649, 870 BTC, equivalent to roughly 3. 1% of the cryptocurrency’s maximum supply. Bitcoin News: Purchase Arrives Amid Sub-1. 0 mNAV Trading The aggressive accumulation occurred while Strategy’s stock traded at a discount to its underlying Bitcoin holdings. At press time, MSTR shares reflected an mNAV of 0. 93, meaning investors valued the stock below the company’s net asset value. Strategy’s mNAV first breached 1. 0 on November 13 when shares traded at $222. 31, declining 1. 2% in early trading. Bitcoin Treasuries data recorded the mNAV at 0. 977 that day, marking the first instance the firm traded below net asset value since January 11, 2024. The development represented a fundamental shift in how markets valued digital asset treasury companies. The premium that MSTR stock commanded over its Bitcoin reserves evaporated as investor sentiment shifted amid tightening liquidity and broader pressure in the crypto industry. 75 and $249. 56. The transactions generated approximately $2. 58 million in proceeds.

OTC Desks Hit Highest BTC Balances Since August – What It Means for Bitcoin’s Price

Data shows that weak hands flood Binance, while BTC whales and institutions steadily buy without accelerating purchases.

Bitcoin (BTC) Price Today: BTC Tests $98K Resistance as Hidden Bullish Divergences Hint at $107K Corrective Bounce

The post Bitcoin is closely eyeing $98K resistance while holding key $90K support, as technical indicators reveal that recent moves toward $107K are still corrections. Hidden bullish divergences on RSI, MACD, and Stochastics suggest potential short-term strength, but on-chain data and market structure point to caution. Traders and investors are monitoring these critical levels to gauge Bitcoin’s next move in an increasingly volatile market. Bitcoin Holds Key Levels Amid Market Uncertainty Bitcoin (BTC) is trading near $95,000 as of November 17, 2025, following a 25% pullback from its October all-time high of around $130,000. Historically, Bitcoin has experienced similar 20-30% retracements in post-halving cycles before resuming trend acceleration, as seen in 2017 and 2020. The current consolidation resembles those previous ranges, signaling a period of careful observation rather than panic. Bitcoin remains in a no-trade zone, eyeing $98K resistance or risking a drop to $90K support.” This reflects the need for traders to wait for clear signals before taking positions. Technical Indicators Signal Caution Several technical factors suggest Bitcoin may encounter heightened volatility. The daily chart shows an approaching “death cross,” a pattern in which the 50-day moving average crosses below the 200-day moving average. While this historically signals momentum loss and potential 20-30% corrections, bull-market cycles can sometimes produce false signals, requiring additional context. Bitcoin’s moves toward $107K remain corrective, with cautious momentum as USDT dominance rises and $90. 5K support holds critical risk levels.

Best Cryptos to Buy Now: Why Analysts Are Moving Bitcoin Profits Into XRP Tundra’s Ecosystem

The post Best Cryptos to Buy Now: Why Analysts Are Moving Bitcoin Profits Into XRP Tundra’s Ecosystem appeared com. Bitcoin’s latest cycle has delivered exactly what many long-term holders were waiting for: a new all-time high above $126,000 followed by a sharp reset. Recent data shows BTC has fallen more than 20% from its October peak, with price action oscillating around the psychologically important $100,000 level as sentiment normalizes. For analysts who treat Bitcoin as a macro asset rather than a trading toy, that combination of realized gains and renewed volatility has reopened the question of where fresh capital should go next. Increasingly, research desks and independent commentators are looking beyond BTC itself toward yield-bearing, audited ecosystems such as XRP Tundra that can convert profits into structured, chain-level cashflow. Bitcoin’s Rally Resets the “Best Crypto to Buy Now” Discussion In October, Bitcoin’s move through the $126,000 mark was driven by spot ETF inflows, high conviction from institutional buyers and a still-accommodative macro backdrop. That momentum reversed quickly when a liquidation wave and shifting interest-rate expectations pushed BTC more than 20% off the highs, briefly taking it below $100,000 before a modest recovery. The current environment reflects a period where many holders are securing gains while the market resets after October’s peak. Reports from major research outlets show 2025 BTC targets clustered between roughly $120,000 and $200,000, indicating that upside remains but is less asymmetrical than it was before this year’s breakout. That is leading some analysts to frame Bitcoin as the “engine” that generates gains, and yield-oriented DeFi projects as the destination where those gains are put to work. Within that framework, XRP Tundra is appearing on several “best cryptos to buy now” shortlists because analysts view its dual-chain architecture, presale economics and future yield design as fundamentally different from short-term speculative plays. Why Analysts Funnel Realized Bitcoin Gains Into Yield-Based DeFi The thematic rotation out of pure beta and.

The New York Times

The New York Times

- Tom Pritzker, Hyatt Heir, Steps Down as Executive Chairman Over Links to Epstein 2026 年 2 月 17 日 Rebecca Davis O’Brien

- Colbert Doesn’t Give an FCC About Calling Out CBS 2026 年 2 月 17 日 Trish Bendix

- U.S. and Iran Gear Up for Nuclear Talks Amid Rising Tensions 2026 年 2 月 17 日 Aaron Boxerman

- Memorials for Iran’s Slain Protesters Wil Test of State Crackdown 2026 年 2 月 17 日 Erika Solomon and Leily Nikounazar

- Ukraine and Russia Hold New Round of Peace Talks, but Expectations Are Low 2026 年 2 月 17 日 Constant Méheut

- Questions Swirl Around Russian Figure Skater in Her Olympic Debut 2026 年 2 月 17 日 Juliet Macur

- Los Angeles Mayor Karen Bass 2026 年 2 月 17 日 Shawn Hubler

- 2 Killed in Shooting at High School Hockey Game in Rhode Island 2026 年 2 月 17 日 Neil Vigdor and Thomas Gibbons-Neff

- Anderson Cooper Is Leaving ’60 Minutes’ 2026 年 2 月 17 日 Benjamin Mullin

- Frederick Wiseman Watched People Like Nobody Else 2026 年 2 月 17 日 Alissa Wilkinson