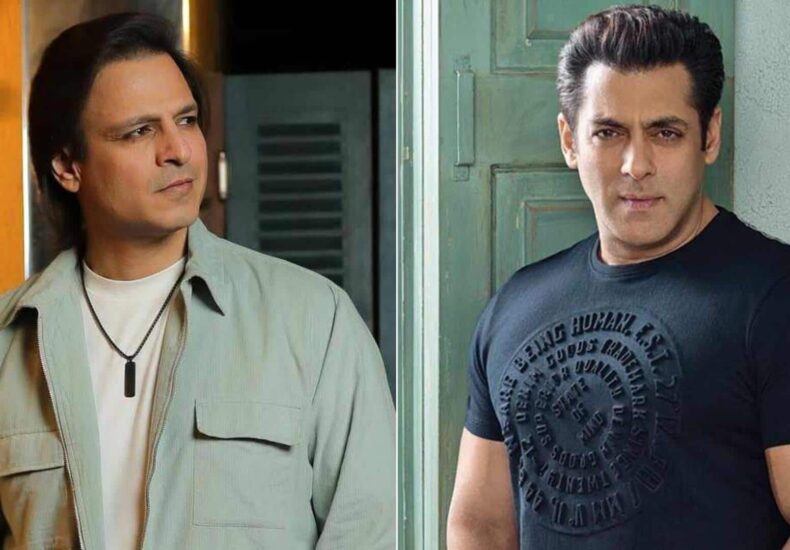

Vivek recalls being ‘thrown out of films’ after Salman controversy

**Gamemaker EA Might Be Sold for $50 Billion Next Week**

*By Dwaipayan Roy | Sep 27, 2025, 10:12 AM*

—

**What’s the Story?**

Electronic Arts (EA), the renowned video game publisher behind blockbuster franchises like FIFA and Battlefield, is reportedly in advanced talks for a private acquisition. The deal, which could be announced as early as next week, is valued at approximately $50 billion.

A consortium of investors, including private equity firm Silver Lake, Saudi Arabia’s Public Investment Fund (PIF), and Jared Kushner’s Affinity Partners, are involved in these discussions.

—

**Historic Deal in the Making**

If finalized, this acquisition would mark the largest leveraged buyout in history. A leveraged buyout (LBO) is a financial transaction where the acquirer uses borrowed funds to purchase a company.

Following reports about EA’s potential sale, the company’s shares surged over 15% during Friday afternoon trading.

The gaming industry, meanwhile, continues to face challenges such as rising development costs, stiff competition, and the need to meet high fan expectations amid declining discretionary consumer spending.

—

**Market Outlook: EA’s Valuation and Growth Potential**

EA currently holds a market valuation exceeding $42 billion. Despite projecting quarterly net bookings below Wall Street expectations in July, the company is optimistic about its future.

Central to EA’s growth strategy is the upcoming release of *Battlefield 6*, the latest entry in its popular shooter game series. Slated for release within EA’s current fiscal year, *Battlefield 6* is expected to generate strong sales and compete directly with Activision Blizzard’s *Call of Duty* franchise.

—

**Investor Profiles: The Consortium Behind the Deal**

The investor group comprises:

– **Silver Lake**: A leading tech-focused private equity firm known for significant technology buyouts, including a recent majority stake acquisition in Intel’s Altera for $4.46 billion.

– **Public Investment Fund (PIF)**: Saudi Arabia’s sovereign wealth fund, part of the nation’s Vision 2030 initiative, which has diversified investments beyond oil into gaming and other sports sectors.

– **Affinity Partners**: Founded by Jared Kushner, former US President Donald Trump’s son-in-law, with backing from investment funds in Saudi Arabia, Qatar, and the UAE.

—

This potential acquisition highlights the growing financial interest in the gaming industry and could reshape the landscape for EA and its competitors moving forward.

https://www.newsbytesapp.com/news/entertainment/vivek-oberoi-recalls-losing-films-after-fight-with-salman/story

You may also like

推荐阅读

You may be interested

Clovis Police now using drones as ‘first responders’

**Clovis Police Department Introduces Drone First Responders to Enhance Public...

Guns and butter: Russia chooses both

A required part of this site couldn’t load. This may...

Sanjay Mishra Buys ₹4.75 Cr Sea-View Flat In Mumbai, But Guess Which Celebs Are His Neighbours?

Mumbai: Popular Bollywood actor Sanjay Mishra has purchased a luxurious...

The New York Times

The New York Times

- Department of Homeland Security Shuts Down, Though Essential Work Continues 2026 年 2 月 14 日 Madeleine Ngo

- Casey Wasserman Will Sell Entertainment Agency Amid Epstein Files Fallout 2026 年 2 月 14 日 Shawn Hubler, Ben Sisario and Emmanuel Morgan

- New Research Absolves the Woman Blamed for a Dynasty’s Ruin 2026 年 2 月 14 日 Andrew Higgins

- How China Built a Chip Industry, and Why It’s Still Not Enough 2026 年 2 月 14 日 Meaghan Tobin

- ’The Interview’: Gisèle Pelicot Shares Her Story 2026 年 2 月 14 日 Lulu Garcia-Navarro

- Ramping Up Election Attacks, Trump Does Not Let Reality Get in His Way 2026 年 2 月 14 日 Katie Rogers

- Consultants Offered Epstein Access to Top N.Y. Democrats if He Donated 2026 年 2 月 14 日 Jay Root and Bianca Pallaro

- ICE Agents Menaced Minnesota Protesters at Their Homes, Filings Say 2026 年 2 月 14 日 Jonah E. Bromwich

- Trump Administration Tells Judge It Will Release Gateway Funding 2026 年 2 月 13 日 Patrick McGeehan

- Florida Couple Arrested After Pickleball Match Turns Into a Brawl 2026 年 2 月 13 日 Neil Vigdor

Leave a Reply