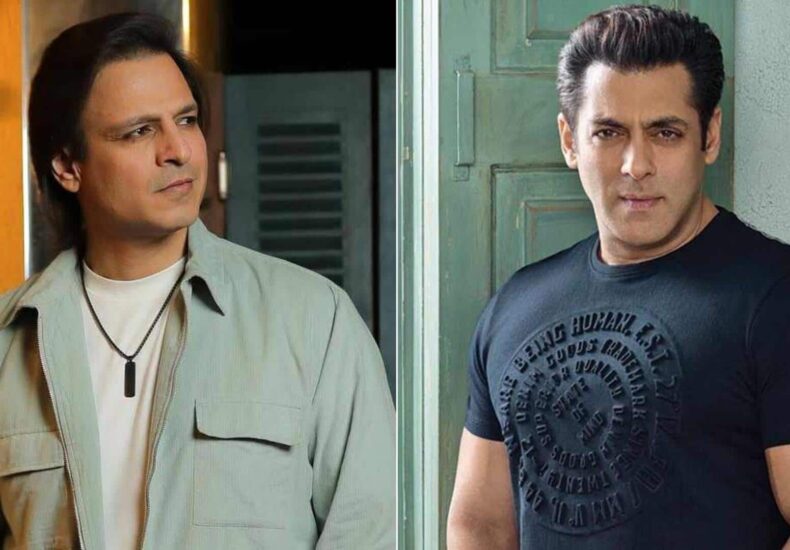

Vivek recalls being ‘thrown out of films’ after Salman controversy

**Gamemaker EA Might Be Sold for $50 Billion Next Week**

*By Dwaipayan Roy | Sep 27, 2025, 10:12 AM*

—

**What’s the Story?**

Electronic Arts (EA), the renowned video game publisher behind major franchises like FIFA and Battlefield, is reportedly in advanced talks for a private acquisition. The deal, potentially set to be announced as early as next week, is valued at approximately $50 billion.

A consortium of investors—including private equity firm Silver Lake, Saudi Arabia’s Public Investment Fund (PIF), and Jared Kushner’s Affinity Partners—is said to be involved in these discussions.

—

**Historic Deal: Potential Record-Breaking Leveraged Buyout**

If finalized, this transaction would mark the largest leveraged buyout in history. A leveraged buyout (LBO) is a financial maneuver where the acquiring party uses borrowed funds to purchase a company.

Following reports of EA’s potential sale, its shares surged over 15% on Friday afternoon, signaling strong market interest.

—

**Industry Context**

The gaming industry has been grappling with rising development costs and intense competition, all while striving to meet high fan expectations amid declining consumer discretionary spending.

—

**Market Outlook: EA’s Valuation and Upcoming Game Releases**

Currently, EA boasts a market valuation exceeding $42 billion. Although the company projected quarterly net bookings below Wall Street expectations in July, it is pinning hopes on the launch of *Battlefield 6*—the latest installment in its popular shooter series—to boost sales.

Slated for release within EA’s current fiscal year, *Battlefield 6* is expected to sell millions of copies and compete directly with Activision Blizzard’s *Call of Duty* franchise.

—

**Investor Profiles: Consortium Details**

– **Silver Lake:** A leading tech-focused private equity firm known for major buyouts, including its recent $4.46 billion majority stake acquisition in Intel’s Altera.

– **Public Investment Fund (PIF):** Saudi Arabia’s sovereign wealth fund, part of the “Vision 2030” strategy, has been diversifying beyond oil with significant investments in gaming and sports sectors.

– **Affinity Partners:** Founded by Jared Kushner, former US President Donald Trump’s son-in-law, this firm has investments sourced from funds in Saudi Arabia, Qatar, and the UAE.

—

This landmark deal, should it go through, could reshape the video game industry landscape and set new precedents in large-scale leveraged buyouts.

https://www.newsbytesapp.com/news/entertainment/vivek-oberoi-recalls-losing-films-after-fight-with-salman/story

You may also like

更多推荐

You may be interested

Clovis Police now using drones as ‘first responders’

**Clovis Police Department Introduces Drone First Responders to Enhance Public...

Guns and butter: Russia chooses both

A required part of this site couldn’t load. This may...

Sanjay Mishra Buys ₹4.75 Cr Sea-View Flat In Mumbai, But Guess Which Celebs Are His Neighbours?

Mumbai: Popular Bollywood actor Sanjay Mishra has purchased a luxurious...

The New York Times

The New York Times

- Department of Homeland Security Shuts Down, Though Essential Work Continues 2026 年 2 月 14 日 Madeleine Ngo

- Casey Wasserman Will Sell Entertainment Agency Amid Epstein Files Fallout 2026 年 2 月 14 日 Shawn Hubler, Ben Sisario and Emmanuel Morgan

- New Research Absolves the Woman Blamed for a Dynasty’s Ruin 2026 年 2 月 14 日 Andrew Higgins

- How China Built a Chip Industry, and Why It’s Still Not Enough 2026 年 2 月 14 日 Meaghan Tobin

- ’The Interview’: Gisèle Pelicot Shares Her Story 2026 年 2 月 14 日 Lulu Garcia-Navarro

- Ramping Up Election Attacks, Trump Does Not Let Reality Get in His Way 2026 年 2 月 14 日 Katie Rogers

- Consultants Offered Epstein Access to Top N.Y. Democrats if He Donated 2026 年 2 月 14 日 Jay Root and Bianca Pallaro

- ICE Agents Menaced Minnesota Protesters at Their Homes, Filings Say 2026 年 2 月 14 日 Jonah E. Bromwich

- Trump Administration Tells Judge It Will Release Gateway Funding 2026 年 2 月 13 日 Patrick McGeehan

- Florida Couple Arrested After Pickleball Match Turns Into a Brawl 2026 年 2 月 13 日 Neil Vigdor

Leave a Reply