Day: November 7, 2025

Japan’s FSA Proposes Tighter Crypto Lending and IEO Rules to Safeguard Investors

The post Japan’s FSA Proposes Tighter Crypto Lending and IEO Rules to Safeguard Investors appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Japan’s Financial Services Agency (FSA) is introducing stricter crypto regulations to safeguard investors by regulating crypto lending under the Financial Instruments and Exchange Act and imposing caps on Initial Exchange Offerings (IEOs). These measures address risks like inadequate disclosures and overinvestment, with implementation targeted for 2026. Crypto lending operations will require registration and robust risk management to close existing loopholes for unregistered businesses. The regulations aim to ensure secure custody of assets and clear communication of price fluctuation and credit risks to users. IEO investment limits, such as capping individual purchases at 500, 000 Yen for most cases, will prevent excessive exposure in crowdfunding scenarios, based on historical data from domestic offerings. Japan’s crypto regulations are evolving with FSA’s new rules on lending and IEOs to protect investors from high risks. Learn how these changes under the Financial Instruments Act will reshape the market by 2026-stay ahead with expert insights. What are Japan’s New Crypto Regulations? Japan’s crypto regulations focus on enhancing investor protection by subjecting crypto lending to stricter oversight under the Financial Instruments and Exchange Act, shifting from.

New York State Officials Approve Proposal for Controversial Underwater Gas Pipeline

The contentious proposal, previously rebuffed by state regulators who expressed environmental concerns, was deemed acceptable on Friday.

Iowa: Student arrested after being caught on camera flipping over Turning Point USA table

A 19-year-old University of Iowa student named Justin Pham Calhoon was caught on video flipping over a promotional table set up by the campus chapter of Turning Point USA (TPUSA), leading to his arrest.

Cherry Hill Mortgage Investment Corporation (CHMI) Q3 2025 Earnings Call Transcript

Cherry Hill Mortgage Investment Corporation (CHMI) Q3 2025 Earnings Call Transcript

Predator: Badlands Has The Most Emotional And Brutal Opening Scene In The Franchise’s History

Dan Trachtenberg’s “Predator: Badlands” contains several brutal moments, but the most shocking of the lot may well be the heartbreaking opening scene.

Your Guide To Finding Amazon Proofreading Jobs As A Beginner – 8 Best Ways

Are you good with words? Sharp-eyed? Attentive to details? And would you like to take a shot at working for Amazon? Read on to know more about Amazon proofreading jobs. Originally focused on selling books, Amazon is now the world’s biggest online retailer of electronics, toys, housewares, movies, music, and many other items. Thus, with . Read more.

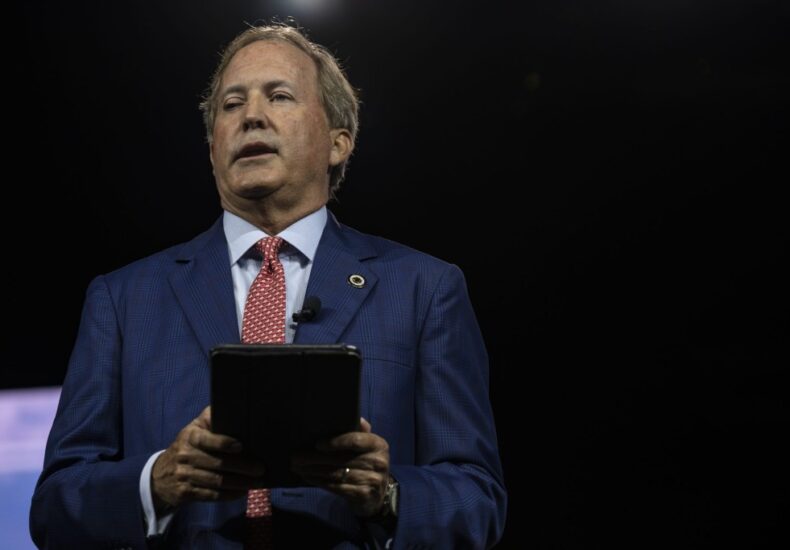

Texas AG Ken Paxton sues Galveston ISD for not displaying Ten Commandments in classrooms

A federal judge has barred 11 school districts from implementing the state law, calling it unconstitutional. Paxton has ordered all other districts to display the Ten Commandments.

Here’s 8 minutes of Clippers’ Bradley Beal having one of the worst games you’ll ever see

Bradley Beal’s return to Phoenix was supposed to be a statement game. Instead, it turned into a lowlight reel the Clippers would rather forget. In a 115-102 loss to the Suns on Thursday night, the Los Angeles Clippers bottomed out. They trailed by as many as 25 points and watched their newest star endure one [.] The post Here’s 8 minutes of Clippers’ Bradley Beal having one of the worst games you’ll ever see appeared first on ClutchPoints.

Kim Davis’ Divorces Called Out as She Fights Gay Marriage in Supreme Court

Former Kentucky court clerk Kim Davis is urging the Supreme Court to take on her case challenging gay marriage.

In Orlando theme parks, animatronics increase in number — and in realism

Increasingly high-tech, lifelike figures add entertainment value at Walt Disney World and Universal Orlando.

The New York Times

The New York Times

- How Europe Is Moving to Reduce Dependence on Trump 2026 年 1 月 31 日 Jeanna Smialek, Lara Jakes, Steven Erlanger and Jim Tankersley

- U.S. Allies Are Drawing Closer to China, but on Beijing’s Terms 2026 年 1 月 31 日 David Pierson and Berry Wang

- Draft Epstein Indictment Accused Him of Crimes Against More Than a Dozen Girls 2026 年 1 月 31 日 Devlin Barrett

- ICE Expands Power of Agents to Arrest People Without Warrants 2026 年 1 月 31 日 Hamed Aleaziz and Charlie Savage

- ‘Melania’ Review: 20 Stage-Managed Days in the Life of the First Lady 2026 年 1 月 31 日 Manohla Dargis

- Trump Called for ‘De-Escalation’ in Minneapolis. It Didn’t Last Long. 2026 年 1 月 31 日 Zolan Kanno-Youngs

- Trump Officials Bypass Congress to Push Billions in Weapons Aid to Israel 2026 年 1 月 31 日 Edward Wong

- Grand Jury Hears Evidence on Brooklyn Power Broker 2026 年 1 月 31 日 William K. Rashbaum and Dana Rubinstein

- Release of Three Million Epstein Pages Falls Short, Survivors Say 2026 年 1 月 31 日 Devlin Barrett, Michael Gold and Mike Baker

- Could the Hudson River Freeze Over? 2026 年 1 月 31 日 Amy Graff and Joel Eastwood